Home Depot 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

term of the applicable ASR agreement. The $2.7 billion of shares repurchased are included in Treasury Stock in the

accompanying Consolidated Balance Sheets.

In fiscal 2013, the Company entered into ASR agreements with third-party financial institutions to repurchase $6.2 billion of

the Company’s common stock. Under the agreements, the Company paid $6.2 billion to the financial institutions and received

a total of 81 million shares in fiscal 2013. The final number of shares delivered upon settlement of each agreement was

determined with reference to the average price of the Company’s common stock over the term of the applicable ASR

agreement. The $6.2 billion of shares repurchased are included in Treasury Stock in the accompanying Consolidated Balance

Sheets.

In fiscal 2012, the Company entered into ASR agreements with third-party financial institutions to repurchase $3.05 billion of

the Company’s common stock. Under the agreements, the Company paid $3.05 billion to the financial institutions and

received a total of 58 million shares in fiscal 2012. The final number of shares delivered upon settlement of each agreement

was determined with reference to the average price of the Company’s common stock over the term of the applicable ASR

agreement. The $3.05 billion of shares repurchased are included in Treasury Stock in the accompanying Consolidated

Balance Sheets.

In March 2015, the Company entered into an ASR agreement with a third-party financial institution to repurchase $850

million of the Company's common stock. Under the agreement, the Company paid $850 million to the financial institution

and received an initial delivery of approximately 7 million shares in the first quarter of fiscal 2015. The final number of

shares delivered upon settlement of the agreement will be determined with reference to the average price of the Company's

common stock over the term of the ASR agreement.

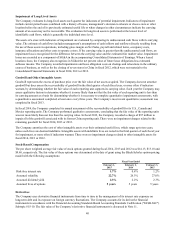

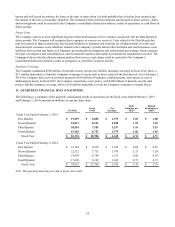

6. INCOME TAXES

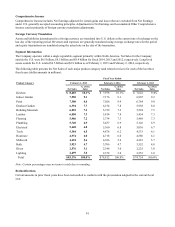

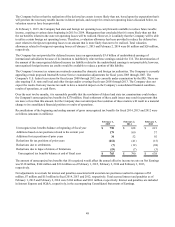

The components of Earnings before Provision for Income Taxes for fiscal 2014, 2013 and 2012 were as follows (amounts in

millions):

Fiscal Year Ended

February 1,

2015 February 2,

2014 February 3,

2013

United States $ 9,217 $ 7,770 $ 6,677

Foreign 759 697 544

Total $ 9,976 $ 8,467 $ 7,221

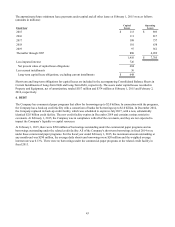

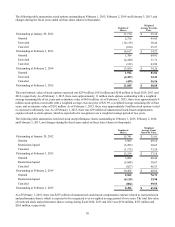

The Provision for Income Taxes consisted of the following (amounts in millions):

Fiscal Year Ended

February 1,

2015 February 2,

2014 February 3,

2013

Current:

Federal $ 2,884 $ 2,503 $ 2,060

State 373 346 302

Foreign 258 265 230

3,515 3,114 2,592

Deferred:

Federal 127 (12) 114

State (11)4 1

Foreign —(24)(21)

116 (32) 94

Total $ 3,631 $ 3,082 $ 2,686

The Company’s combined federal, state and foreign effective tax rates for fiscal 2014, 2013 and 2012 were approximately

36.4%, 36.4% and 37.2%, respectively.