Home Depot 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

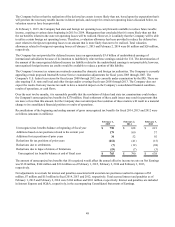

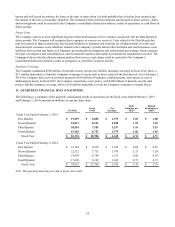

8. EMPLOYEE BENEFIT PLANS

The Company maintains active defined contribution retirement plans for its employees (the "Benefit Plans"). All associates

satisfying certain service requirements are eligible to participate in the Benefit Plans. The Company makes cash contributions

each payroll period up to specified percentages of associates’ contributions as approved by the Board of Directors.

The Company also maintains a restoration plan to provide certain associates deferred compensation that they would have

received under the Benefit Plans as a matching contribution if not for the maximum compensation limits under the Internal

Revenue Code. The Company funds the restoration plan through contributions made to a grantor trust, which are then used to

purchase shares of the Company’s common stock in the open market.

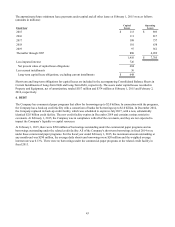

The Company’s contributions to the Benefit Plans and the restoration plan were $182 million, $184 million and $182 million

for fiscal 2014, 2013 and 2012, respectively. At February 1, 2015, the Benefit Plans and the restoration plan held a total of 10

million shares of the Company’s common stock in trust for plan participants.

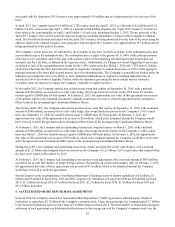

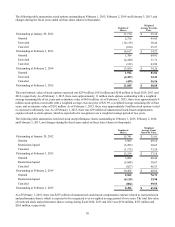

9. CHINA STORE CLOSINGS

In fiscal 2012, the Company closed its remaining seven big box stores in China. As a result of the closings, the Company

recorded a total charge of $145 million, net of tax, in fiscal 2012. Inventory markdown costs of $10 million are included in

Cost of Sales, and $135 million of costs related to the impairment of goodwill and other assets, lease terminations, severance

and other charges are included in SG&A in the accompanying Consolidated Statements of Earnings.

10. DEBT GUARANTEE

In connection with the sale of HD Supply, Inc. on August 30, 2007, the Company guaranteed a $1.0 billion senior secured

amortizing term loan of HD Supply, Inc. The original expiration date of the guarantee was August 30, 2012. In March 2010,

the Company amended the guarantee to extend the expiration date to April 1, 2014. The fair value of the guarantee at August

30, 2007 was $16 million and was recorded as a liability of the Company in Other Long-Term Liabilities. The extension of

the guarantee increased the fair value of the guarantee to $67 million, resulting in a $51 million charge to Interest and Other,

net, for fiscal 2010. In April 2012, the term loan guarantee was terminated. As a result, the Company reversed its $67 million

liability related to the guarantee, resulting in a $67 million pretax benefit to Interest and Other, net, for fiscal 2012.

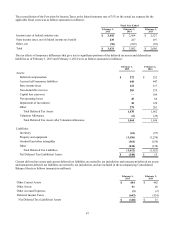

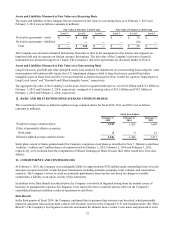

11. FAIR VALUE MEASUREMENTS

The fair value of an asset is considered to be the price at which the asset could be sold in an orderly transaction between

unrelated knowledgeable and willing parties. A liability’s fair value is defined as the amount that would be paid to transfer the

liability to a new obligor, rather than the amount that would be paid to settle the liability with the creditor. Assets and

liabilities recorded at fair value are measured using a three-tier fair value hierarchy, which prioritizes the inputs used in

measuring fair value. These tiers are:

• Level 1 – Observable inputs that reflect quoted prices in active markets

• Level 2 – Inputs other than quoted prices in active markets that are either directly or indirectly observable

• Level 3 – Unobservable inputs in which little or no market data exists, therefore requiring the Company to

develop its own assumptions