Home Depot 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

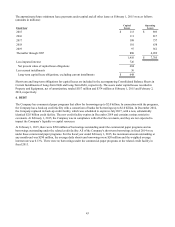

2. INVESTMENT IN HD SUPPLY HOLDINGS, INC.

At the end of fiscal 2013, the Company owned 16.3 million shares of HD Supply Holdings, Inc. ("HD Supply") common

stock, which represented approximately 8% of the shares of HD Supply common stock outstanding. This investment is

accounted for using the cost method, as there are significant restrictions in place on the Company's ability to sell or transfer

its HD Supply shares. The restrictions are controlled by the three largest shareholders of HD Supply (the "Principal

Shareholders") for so long as they continue to own a certain portion of their original holdings of HD Supply. The carrying

value of the HD Supply shares was impaired by the Company to a zero cost basis in fiscal 2009.

In the first quarter of fiscal 2014, the Principal Shareholders elected to sell shares of HD Supply common stock in a

secondary public offering (the "May Offering"). Under the terms of a registration rights agreement among the Company, HD

Supply and the Principal Shareholders (the "Registration Rights Agreement"), the Company had the right to include a portion

of its shares in the May Offering and elected to do so. During the third and fourth quarters of fiscal 2014, two of the Principal

Shareholders again elected to sell shares of HD Supply common stock in secondary public offerings, and the Company again

exercised its rights under the Registration Rights Agreement to include a portion of its shares in these offerings. As a result of

all of these offerings (including an overallotment option exercised during the second quarter of fiscal 2014 by the

underwriters of the May Offering), the Company sold 12.2 million shares of HD Supply common stock in fiscal 2014, for

which it received $323 million of proceeds and recognized a corresponding gain in fiscal 2014.

The total pretax gain of $323 million is included in Interest and Investment Income in the accompanying Consolidated

Statements of Earnings for fiscal 2014. The remaining 4.1 million shares owned by the Company, which represent

approximately 2% of the shares of HD Supply common stock outstanding, continue to be accounted for using the cost

method as the restrictions on these shares remain in place.

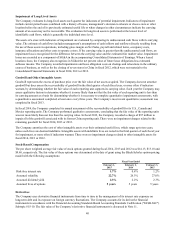

3. PROPERTY AND LEASES

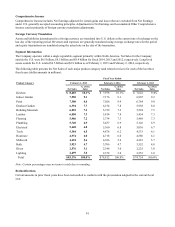

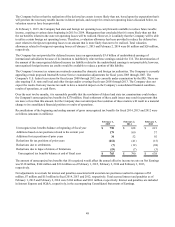

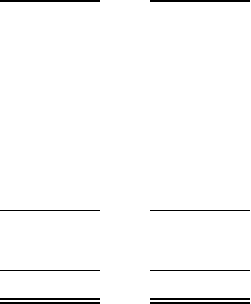

Property and Equipment as of February 1, 2015 and February 2, 2014 consisted of the following (amounts in millions):

February 1,

2015 February 2,

2014

Property and Equipment, at cost:

Land $ 8,243 $ 8,375

Buildings 17,759 17,950

Furniture, Fixtures and Equipment 9,602 10,107

Leasehold Improvements 1,419 1,388

Construction in Progress 585 548

Capital Leases 905 696

38,513 39,064

Less Accumulated Depreciation and Amortization 15,793 15,716

Net Property and Equipment $ 22,720 $ 23,348

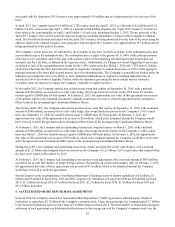

The Company leases certain retail locations, office space, warehouse and distribution space, equipment and vehicles. While

most of the leases are operating leases, certain locations and equipment are leased under capital leases. As leases expire, it

can be expected that in the normal course of business certain leases will be renewed or replaced.

Certain lease agreements include escalating rents over the lease terms. The Company expenses rent on a straight-line basis

over the lease term, which commences on the date the Company has the right to control the property. The cumulative expense

recognized on a straight-line basis in excess of the cumulative payments is included in Other Accrued Expenses and Other

Long-Term Liabilities in the accompanying Consolidated Balance Sheets.

Total rent expense, net of minor sublease income, for fiscal 2014, 2013 and 2012 was $918 million, $905 million and $849

million, respectively. Certain store leases also provide for contingent rent payments based on percentages of sales in excess of

specified minimums. Contingent rent expense for fiscal 2014, 2013 and 2012 was approximately $7 million, $5 million and

$4 million, respectively. Real estate taxes, insurance, maintenance and operating expenses applicable to the leased property

are obligations of the Company under the lease agreements.