Home Depot 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

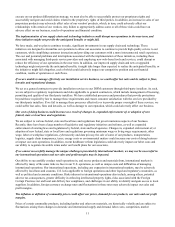

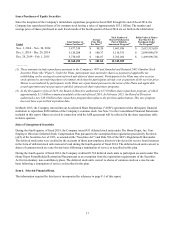

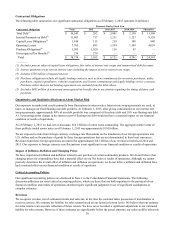

Issuer Purchases of Equity Securities

Since the inception of the Company's initial share repurchase program in fiscal 2002 through the end of fiscal 2014, the

Company has repurchased shares of its common stock having a value of approximately $53.1 billion. The number and

average price of shares purchased in each fiscal month of the fourth quarter of fiscal 2014 are set forth in the table below:

Period Total Number of

Shares Purchased(1)

Average

Price Paid

Per Share(1)

Total Number of

Shares Purchased as

Part of Publicly

Announced Program(2)

Dollar Value of Shares

that May Yet Be

Purchased Under

the Program(2)

Nov. 3, 2014 – Nov. 30, 2014 1,477,359 $ 98.20 1,463,956 $ 2,613,513,610

Dec. 1, 2014 – Dec. 28, 2014 5,120,208 $ 100.37 5,116,351 $ 2,099,998,678

Dec. 29, 2014 – Feb. 1, 2015 5,770,925 $ 104.07 5,765,202 $ 1,499,998,756

12,368,492 $ 101.84 12,345,509

—————

(1) These amounts include repurchases pursuant to the Company’s 1997 and Amended and Restated 2005 Omnibus Stock

Incentive Plans (the "Plans"). Under the Plans, participants may surrender shares as payment of applicable tax

withholding on the vesting of restricted stock and deferred share awards. Participants in the Plans may also exercise

stock options by surrendering shares of common stock that the participants already own as payment of the exercise price.

Shares so surrendered by participants in the Plans are repurchased pursuant to the terms of the Plans and applicable

award agreement and not pursuant to publicly announced share repurchase programs.

(2) In the first quarter of fiscal 2013, the Board of Directors authorized a $17.0 billion share repurchase program, of which

approximately $1.5 billion remained available at the end of fiscal 2014. In February 2015, the Board of Directors

authorized a new $18.0 billion share repurchase program that replaces the previous authorization. This new program

does not have a prescribed expiration date.

In March 2015, the Company entered into an Accelerated Share Repurchase ("ASR") agreement with a third-party financial

institution to repurchase $850 million of the Company's common stock. See Note 5 to the Consolidated Financial Statements

included in this report. Shares received in connection with the ASR agreement will be reflected in the share repurchase table

in future quarters.

Sales of Unregistered Securities

During the fourth quarter of fiscal 2014, the Company issued 431 deferred stock units under The Home Depot, Inc. Non-

Employee Directors' Deferred Stock Compensation Plan pursuant to the exemption from registration provided by Section 4

(a)(2) of the Securities Act of 1933, as amended (the "Securities Act") and Rule 506 of the SEC's Regulation D thereunder.

The deferred stock units were credited to the accounts of those non-employee directors who elected to receive board retainers

in the form of deferred stock units instead of cash during the fourth quarter of fiscal 2014. The deferred stock units convert to

shares of common stock on a one-for-one basis following a termination of service as described in this plan.

During the fourth quarter of fiscal 2014, the Company credited 20,724 deferred stock units to participant accounts under The

Home Depot FutureBuilder Restoration Plan pursuant to an exemption from the registration requirements of the Securities

Act for involuntary, non-contributory plans. The deferred stock units convert to shares of common stock on a one-for-one

basis following a termination of service as described in this plan.

Item 6. Selected Financial Data.

The information required by this item is incorporated by reference to page F-1 of this report.