Home Depot 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

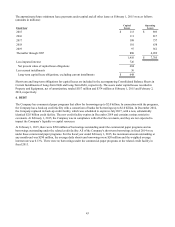

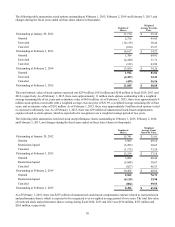

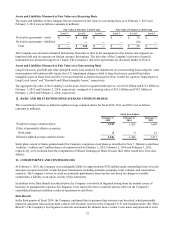

The approximate future minimum lease payments under capital and all other leases at February 1, 2015 were as follows

(amounts in millions):

Fiscal Year Capital

Leases Operating

Leases

2015 $ 113 $ 893

2016 111 817

2017 108 737

2018 101 638

2019 97 561

Thereafter through 2097 880 4,059

1,410 $ 7,705

Less imputed interest 726

Net present value of capital lease obligations 684

Less current installments 36

Long-term capital lease obligations, excluding current installments $ 648

Short-term and long-term obligations for capital leases are included in the accompanying Consolidated Balance Sheets in

Current Installments of Long-Term Debt and Long-Term Debt, respectively. The assets under capital leases recorded in

Property and Equipment, net of amortization, totaled $557 million and $374 million at February 1, 2015 and February 2,

2014, respectively.

4. DEBT

The Company has commercial paper programs that allow for borrowings up to $2.0 billion. In connection with the programs,

the Company has a back-up credit facility with a consortium of banks for borrowings up to $2.0 billion. In December 2014,

the Company replaced its back-up credit facility, which was scheduled to expire in July 2017, with a new, substantially

identical $2.0 billion credit facility. The new credit facility expires in December 2019 and contains various restrictive

covenants. At February 1, 2015, the Company was in compliance with all of the covenants, and they are not expected to

impact the Company’s liquidity or capital resources.

At February 1, 2015, there were $290 million of borrowings outstanding under the commercial paper programs and no

borrowings outstanding under the related credit facility. All of the Company's short-term borrowings in fiscal 2014 were

under these commercial paper programs. For the fiscal year ended February 1, 2015, the maximum amount outstanding at

any month-end was $290 million, the average daily short-term borrowings were $20 million and the weighted average

interest rate was 0.13%. There were no borrowings under the commercial paper programs or the related credit facility in

fiscal 2013.