Home Depot 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

Disciplined Capital Allocation, Productivity and Efficiency – Our approach to driving productivity and efficiency is advanced

through continuous operational improvement in the stores and our supply chain, disciplined capital allocation and building

shareholder value through higher returns on invested capital and total value returned to shareholders in the form of dividends

and share repurchases.

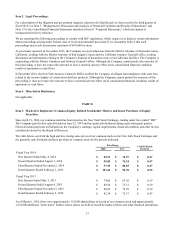

We repurchased a total of 80 million shares for $7.0 billion through Accelerated Share Repurchase ("ASR") agreements and

the open market during fiscal 2014. In addition, in February 2015, our Board of Directors authorized a new $18.0 billion

share repurchase program that replaces the previous authorization, and we announced a 26% increase in our quarterly cash

dividend to $0.59 per share.

In January 2015, we acquired HD Supply Hardware Solutions, known as Crown Bolt, a leading supplier of fasteners and

builders hardware to retailers in the U.S. We expect this acquisition to further enhance our supply chain capabilities and

product offerings in hardware.

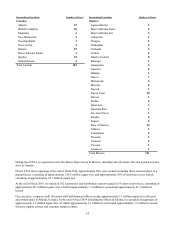

In fiscal 2014, we opened six new stores in Mexico, including one relocation, and opened one new store in Canada, for a total

store count of 2,269 at the end of fiscal 2014. As of the end of fiscal 2014, a total of 292 of our stores, or 12.9%, were located

in Canada and Mexico.

We generated $8.2 billion of cash flow from operations in fiscal 2014. This cash flow, along with $2.0 billion of long-term

debt issued in fiscal 2014 and cash on hand, was used to fund $7.0 billion of share repurchases, pay $2.5 billion of dividends,

fund $1.4 billion in capital expenditures, and pay for the acquisition of HD Supply Hardware Solutions.

Our inventory turnover ratio was 4.7 times at the end of fiscal 2014 compared to 4.6 times at the end of fiscal 2013. Our

return on invested capital (computed on net operating profit after tax for the trailing twelve months and the average of

beginning and ending long-term debt and equity) was 24.9% for fiscal 2014 compared to 20.9% for fiscal 2013.

Interconnected Retail – Our focus on interconnected retail, which connects our other three key initiatives, is based on

building a competitive and seamless platform across all commerce channels. In fiscal 2014, we continued to enhance our

website and mobile experience, resulting in increased traffic to our websites, increased online sales conversion rates and an

increase in the number of orders being picked up in our stores. Almost 40% of our online orders are picked up in our stores

through our Buy Online, Pick-up In Store ("BOPIS") and Buy Online, Ship to Store ("BOSS") programs. Additionally, we

improved navigation, enhanced search capabilities and expanded chat functionality across our online platforms. Sales from

our online channels increased 36.9% for fiscal 2014 compared to fiscal 2013 and represented approximately 4.5% of our total

Net Sales for fiscal 2014.

In fiscal 2014, we started a pilot for Buy Online, Deliver From Store ("BODFS"), which complements our existing BOPIS

and BOSS interconnected retail programs. Further, we opened two of three planned direct fulfillment centers in fiscal 2014

and plan to open the third direct fulfillment center in the second half of fiscal 2015. These highly automated facilities will

support our online growth by providing a balance of cost efficiency and speed in shipping online orders to meet our

customers' needs.