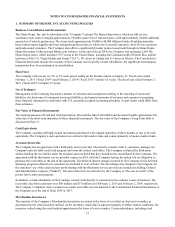

Home Depot 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

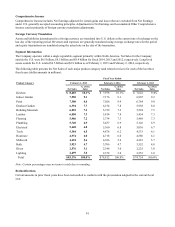

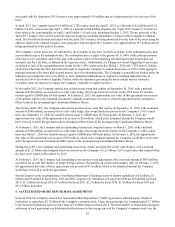

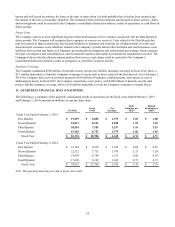

The Company’s Long-Term Debt at the end of fiscal 2014 and 2013 consisted of the following (amounts in millions):

February 1,

2015 February 2,

2014

5.40% Senior Notes; due March 1, 2016; interest payable semi-annually on

March 1 and September 1 $ 3,026 $ 3,042

2.25% Senior Notes; due September 10, 2018; interest payable semi-annually on

March 10 and September 10 1,157 1,148

2.00% Senior Notes; due June 15, 2019; interest payable semi-annually on

June 15 and December 15 996 —

3.95% Senior Notes; due September 15, 2020; interest payable semi-annually on

March 15 and September 15 524 501

4.40% Senior Notes; due April 1, 2021; interest payable semi-annually on

April 1 and October 1 999 999

2.70% Senior Notes; due April 1, 2023; interest payable semi-annually on

April 1 and October 1 999 998

3.75% Senior Notes; due February 15, 2024; interest payable semi-annually on

February 15 and August 15 1,095 1,094

5.875% Senior Notes; due December 16, 2036; interest payable semi-annually on

June 16 and December 16 2,963 2,962

5.40% Senior Notes; due September 15, 2040; interest payable semi-annually on

March 15 and September 15 499 499

5.95% Senior Notes; due April 1, 2041; interest payable semi-annually on

April 1 and October 1 996 996

4.20% Senior Notes; due April 1, 2043; interest payable semi-annually on

April 1 and October 1 996 996

4.875% Senior Notes; due February 15, 2044; interest payable semi-annually on

February 15 and August 15 985 985

4.40% Senior Notes; due March 15, 2045; interest payable semi-annually on

March 15 and September 15 985 —

Capital Lease Obligations; payable in varying installments through January 31, 2055 684 499

Other 35

Total debt 16,907 14,724

Less current installments 38 33

Long-Term Debt, excluding current installments $ 16,869 $ 14,691

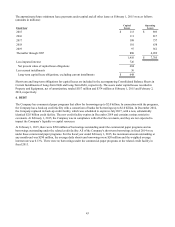

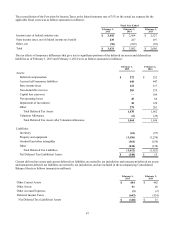

In June 2014, the Company issued $1.0 billion of 2.00% senior notes due June 15, 2019 (the "2019 notes") at a discount of $4

million and $1.0 billion of 4.40% senior notes due March 15, 2045 (the "2045 notes") at a discount of $15 million (together,

the "June 2014 issuance"). Interest on the 2019 notes is due semi-annually on June 15 and December 15 of each year,

beginning December 15, 2014. Interest on the 2045 notes is due semi-annually on March 15 and September 15 of each year,

beginning September 15, 2014. The net proceeds of the June 2014 issuance were used for general corporate purposes,

including repurchases of shares of the Company's common stock. The $19 million discount associated with the June 2014

issuance is being amortized over the term of the notes using the effective interest rate method. Issuance costs associated with

the June 2014 issuance were approximately $14 million and are being amortized over the term of the notes.

In September 2013, the Company issued $1.15 billion of 2.25% senior notes due September 10, 2018 (the "2018 notes") at a

discount of $1 million, $1.1 billion of 3.75% senior notes due February 15, 2024 (the "2024 notes") at a discount of $6

million and $1.0 billion of 4.875% senior notes due February 15, 2044 (the "2044 notes") at a discount of $15 million

(together, the "September 2013 issuance"). Interest on the 2018 notes is due semi-annually on March 10 and September 10 of

each year, beginning March 10, 2014. Interest on the 2024 notes and the 2044 notes is due semi-annually on February 15 and

August 15 of each year, beginning February 15, 2014. The net proceeds of the September 2013 issuance were used for

general corporate purposes, including repayment of the Company's $1.25 billion 5.25% senior notes that matured

December 16, 2013 and repurchases of shares of the Company's common stock. The $22 million discount associated with the

September 2013 issuance is being amortized over the term of the notes using the effective interest rate method. Issuance costs