Family Dollar 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

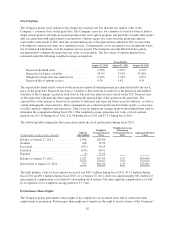

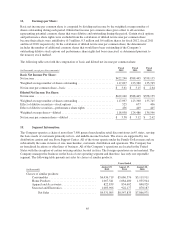

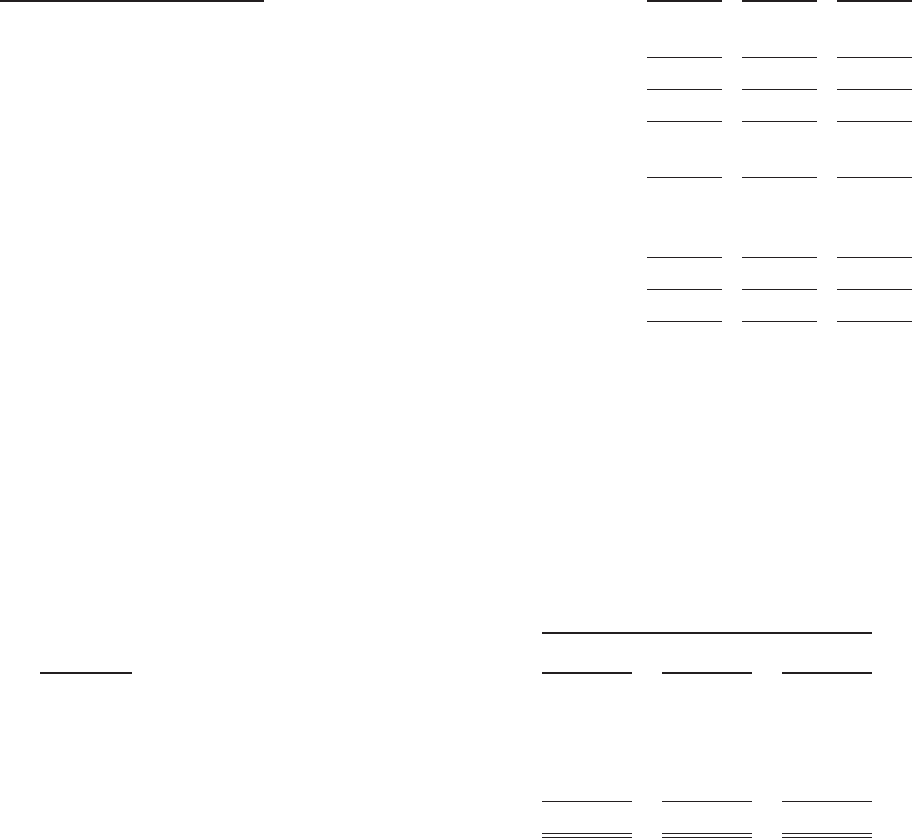

14. Earnings per Share:

Basic net income per common share is computed by dividing net income by the weighted average number of

shares outstanding during each period. Diluted net income per common share gives effect to all securities

representing potential common shares that were dilutive and outstanding during the period. Certain stock options

and performance share rights were excluded from the calculation of diluted net income per common share

because their effects were antidilutive (0.3 million, 0.3 million and 0.6 million shares for fiscal 2012, fiscal 2011

and fiscal 2010, respectively). In the calculation of diluted net income per common share, the denominator

includes the number of additional common shares that would have been outstanding if the Company’s

outstanding dilutive stock options and performance share rights had been exercised, as determined pursuant to

the treasury stock method.

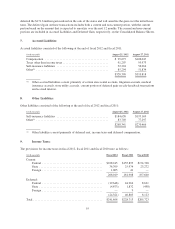

The following table sets forth the computation of basic and diluted net income per common share:

(in thousands, except per share amounts)

Fiscal

2012

Fiscal

2011

Fiscal

2010

Basic Net Income Per Share:

Net income ..................................................... $422,240 $388,445 $358,135

Weighted average number of shares outstanding ........................ 117,097 123,360 135,745

Net income per common share—basic ............................... $ 3.61 $ 3.15 $ 2.64

Diluted Net Income Per Share:

Net income ..................................................... $422,240 $388,445 $358,135

Weighted average number of shares outstanding ........................ 117,097 123,360 135,745

Effect of dilutive securities—stock options ............................ 525 677 406

Effect of dilutive securities—performance share rights .................. 436 449 445

Weighted average shares—diluted ................................... 118,058 124,486 136,596

Net income per common share—diluted .............................. $ 3.58 $ 3.12 $ 2.62

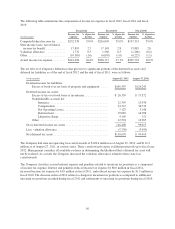

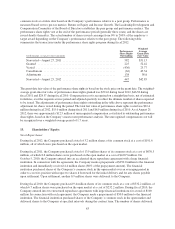

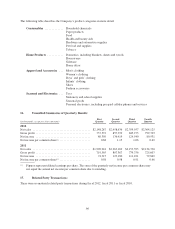

15. Segment Information:

The Company operates a chain of more than 7,400 general merchandise retail discount stores in 45 states, serving

the basic needs of customers primarily in low- and middle-income brackets. The stores are supported by ten

distribution centers and one Store Support Center. All of the stores operate under the Family Dollar name and are

substantially the same in terms of size, merchandise, customers, distribution and operations. The Company has

no franchised locations or other lines of business. All of the Company’s operations are located in the United

States with the exception of certain sourcing entities located in Asia. The foreign operations are not material. The

Company manages the business on the basis of one operating segment and therefore, has only one reportable

segment. The following table presents net sales by classes of similar products.

Years Ended

(in thousands)

August 25,

2012

August 27,

2011

August 28,

2010

Classes of similar products:

Consumables ................................ $6,436,719 $5,686,576 $5,119,911

Home Products .............................. 1,067,541 1,084,480 1,035,944

Apparel and Accessories ....................... 822,839 854,602 840,929

Seasonal and Electronics ....................... 1,003,906 922,177 870,187

Net Sales ............................... $9,331,005 $8,547,835 $7,866,971

65