Family Dollar 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

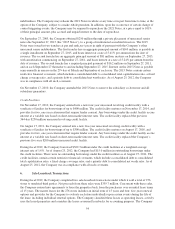

Gender Pay Litigation

On October 14, 2008, a complaint was filed in the U.S. District Court in Birmingham, Alabama, captioned Scott,

et al. v. Family Dollar Stores, Inc., alleging discriminatory pay practices with respect to the Company’s female

store managers. This case was pled as a putative class action or collective action under applicable statutes on

behalf of all current and former female store managers. The plaintiffs seek recovery of back pay, compensatory

and punitive damages, recovery of attorneys’ fees and equitable relief. The case was transferred to the N.C.

Federal Court. Presently, there are 48 named plaintiffs in Scott.

On January 13, 2012, the N.C. Federal Court ruled in the Company’s favor, striking the plaintiffs’ class claims

and denying plaintiffs’ motion to amend their complaint. On January 26, 2012, the plaintiffs filed a petition to

appeal this decision to the Fourth Circuit under Rule 23(f), which the Fourth Circuit granted on May 8, 2012.

Appellate briefing is currently scheduled to be concluded in November, 2012.

At this time, it is not possible to predict whether the Fourth Circuit will affirm the N.C. Federal Court’s decision

striking the class allegations. However, the claims of the 48 named plaintiffs remain under the Equal Pay Act and

Title VII of the Civil Rights Act. Although the Company intends to vigorously defend the action, no assurances

can be given that the Company will be successful in the defense on the merits or otherwise. For these reasons, the

Company is unable to estimate any potential loss or range of loss. The Company has tendered the matter to its

Employment Practices Liability Insurance (“EPLI”) carrier for coverage under its EPLI policy. At this time, the

Company expects that the EPLI carrier will participate in any potential resolution of some or all of the plaintiffs’

claims.

Other Matters

The Company is involved in numerous other legal proceedings and claims incidental to its business, including

litigation related to alleged failures to comply with various state and federal employment laws, some of which

are, or may be pled as class or collective actions, and litigation related to alleged personal or property damage, as

to which the Company carries insurance coverage and/or has established accrued liabilities as set forth in the

Company’s financial statements. While the ultimate outcome cannot be determined, the Company currently

believes that these proceedings and claims, both individually and in the aggregate, should not have a material

effect on the Company’s financial position, liquidity or results of operations. However, the outcome of any

litigation is inherently uncertain and, if decided adversely to the Company, or, if the Company determines that

settlement of such actions is appropriate, the Company may be subject to liability that could have a material

effect on the Company’s financial position, liquidity or results of operations.

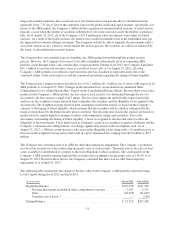

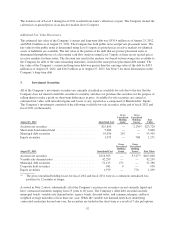

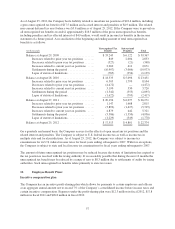

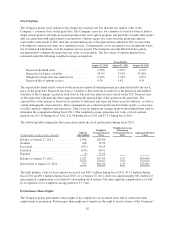

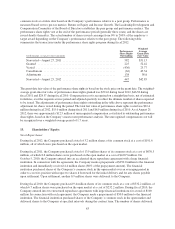

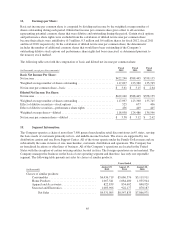

12. Stock-Based Compensation:

The Family Dollar Stores, Inc. 2006 Incentive Plan (the “2006 Plan”) permits the granting of a variety of

compensatory award types. The Company currently grants non-qualified stock options and performance share

rights under the 2006 Plan. Shares issued related to stock options and performance share rights represent new

issuances of common stock. A total of 12.0 million common shares are reserved and available for issuance under

the 2006 Plan, plus any shares awarded under the Company’s previous plan (1989 Non-Qualified Stock Option

Plan) that expired or were canceled or forfeited after the adoption of the 2006 Plan. As of August 25, 2012, there

were 9.4 million shares remaining available for grant under the 2006 Plan. The Company also issues shares under

the 2006 Plan in connection with director compensation. These shares are currently issued out of treasury stock

and are not material.

The Company’s results for fiscal 2012, fiscal 2011 and fiscal 2010 include stock-based compensation expense of

$15.9 million, $14.7 million and $15.7 million, respectively. These amounts are included within SG&A on the

Consolidated Statements of Income. Tax benefits recognized in fiscal 2012, fiscal 2011 and fiscal 2010 for stock-

based compensation totaled $5.9 million, $5.4 million and $5.8 million, respectively.

61