Family Dollar 2012 Annual Report Download - page 58

Download and view the complete annual report

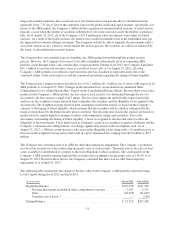

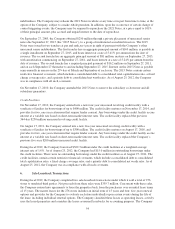

Please find page 58 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.indebtedness. The Company may redeem the 2021 Notes in whole at any time or in part from time to time, at the

option of the Company, subject to a make-whole premium. In addition, upon the occurrence of certain change of

control triggering events, the Company may be required to repurchase the 2021 Notes, at a price equal to 101%

of their principal amount, plus accrued and unpaid interest to the date of repurchase.

On September 27, 2005, the Company obtained $250 million through a private placement of unsecured senior

notes due September 27, 2015 (the “2015 Notes”), to a group of institutional accredited investors. The 2015

Notes were issued in two tranches at par and rank pari passu in right of payment with the Company’s other

unsecured senior indebtedness. The first tranche has an aggregate principal amount of $169 million, is payable in

a single installment on September 27, 2015, and bears interest at a rate of 5.41% per annum from the date of

issuance. The second tranche has an aggregate principal amount of $81 million, matures on September 27, 2015,

with amortization commencing on September 27, 2011, and bears interest at a rate of 5.24% per annum from the

date of issuance. The second tranche has a required principal payment of $16.2 million on September 27, 2011,

and on each September 27 thereafter to and including September 27, 2015. Interest on the 2015 Notes is payable

semi-annually in arrears on the 27th day of March and September of each year. The 2015 Notes contain certain

restrictive financial covenants, which include a consolidated debt to consolidated total capitalization ratio, a fixed

charge coverage ratio, and a priority debt to consolidated net worth ratio. As of August 25, 2012, the Company

was in compliance with all such covenants.

On November 17, 2010, the Company amended the 2015 Notes to remove the subsidiary co-borrower and all

subsidiary guarantors.

Credit Facilities

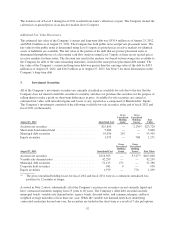

On November 17, 2010, the Company entered into a new four-year unsecured revolving credit facility with a

syndicate of lenders for borrowings of up to $400 million. The credit facility matures on November 17, 2014, and

provides for two, one-year extensions that require lender consent. Any borrowings under the credit facility accrue

interest at a variable rate based on short-term market interest rates. The credit facility replaced the previous

364-day $250 million unsecured revolving credit facility.

On August 17, 2011, the Company entered into a new five-year unsecured revolving credit facility with a

syndicate of lenders for borrowings of up to $300 million. The credit facility matures on August 17, 2016, and

provides for two, one-year extensions that require lender consent. Any borrowings under the credit facility accrue

interest at a variable rate based on short-term market interest rates. The credit facility replaced the Company’s

previous five-year $200 million unsecured credit facility.

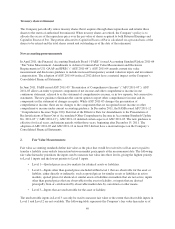

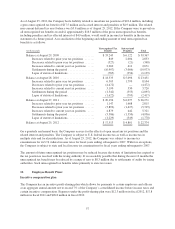

During fiscal 2012, the Company borrowed $362.3 million under the credit facilities at a weighted-average

interest rate of 1.6%. As of August 25, 2012, the Company had $15.0 million in outstanding borrowings under

the credit facilities. There were no outstanding borrowings under the credit facilities as of August 27, 2011. The

credit facilities contain certain restrictive financial covenants, which include a consolidated debt to consolidated

total capitalization ratio, a fixed charge coverage ratio, and a priority debt to consolidated net worth ratio. As of

August 25, 2012, the Company was in compliance with all such covenants.

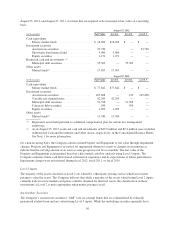

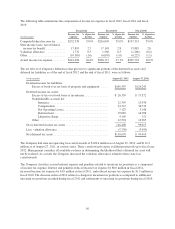

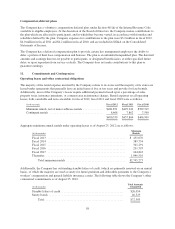

6. Sale-Leaseback Transactions

During fiscal 2012, the Company completed two sale-leaseback transactions under which it sold a total of 276

stores to unrelated third parties. Net proceeds from these sales were $359.7 million. Concurrent with these sales,

the Company entered into agreements to lease the properties back from the purchasers over an initial lease terms

of 15 years. The master leases for the 276 stores includes an initial term of 15 years and four, five-year renewal

options and provides for the Company to evaluate each store individually upon certain events during the life of

the lease, including individual renewal options. The Company classified these leases as operating leases, actively

uses the leased properties and considers the leases as normal leasebacks for accounting purposes. The Company

54