Family Dollar 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investment securities

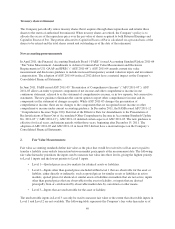

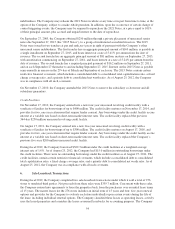

The Company classifies all investment securities as available-for-sale. Securities accounted for as

available-for-sale are required to be reported at fair value with unrealized gains and losses, net of taxes, excluded

from net income and shown separately as a component of accumulated other comprehensive income within

shareholders’ equity. The Company’s short-term investment securities currently consist primarily of debt

securities such as municipal bonds, and variable-rate demand notes. The Company’s long-term investment

securities currently consist of auction rate securities. See Notes 2 and 3 for more information on the Company’s

investment securities.

In addition to the cash and cash equivalents balances discussed above, the Company’s wholly-owned captive

insurance subsidiary also maintains balances in investment securities that are not designated for general corporate

purposes. These investment securities balances were $30.0 million as of the end of fiscal 2012 and $93.0 million

as of the end of fiscal 2011.

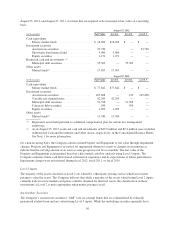

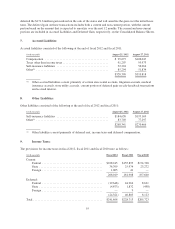

Restricted cash and investments

The Company has restricted cash and investments that serve as collateral for certain of the Company’s insurance

obligations. These restricted funds cannot be withdrawn from the Company’s account without the consent of the

secured party. As of August 25, 2012, the Company held $55.3 million in this restricted account, of which $45.9

million was included in Restricted Cash and Investments and $9.4 million was included in Other Assets in the

Consolidated Balance Sheets. The classification between current and non-current is based on the timing of

expected payments of the secured insurance obligations. Previously, these obligations were collateralized using

standby letters of credit under our revolving credit facilities.

Additionally, in conjunction with the sale-leaseback transactions completed during the second half of fiscal 2012,

certain proceeds from the transactions were placed into an escrow account with an independent third party in

connection with like-kind exchange transactions, which permits the deferral of a portion of the tax gain

associated with the sale of the stores. The Company intends to use these proceeds to purchase additional new

stores and must do so within 180 days from the closing of the transactions to realize the deferral. At the

Company’s option, the proceeds can be returned for general operating needs; however, the tax gain deferral

would not be realized. As of August 25, 2012, the balance in this account was $80.4 million. These assets are

classified as Restricted Cash and Investments in the Consolidated Balance Sheets.

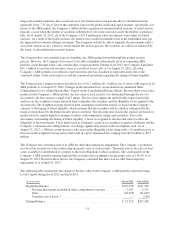

Merchandise inventories

Inventories are valued using the retail method, based on retail prices less mark-on percentages, which

approximates the lower of first-in, first-out (FIFO) cost or market. The Company records adjustments to

inventory through cost of goods sold when retail price reductions, or markdowns, are taken against on-hand

inventory. In addition, the Company makes estimates and judgments regarding, among other things, initial

markups, markdowns, future demand for specific product categories and market conditions, all of which can

significantly impact inventory valuation. These estimates and judgments are based on the application of a

consistent methodology each period. The Company estimates inventory losses for damaged, lost or stolen

inventory (inventory shrinkage) for the period from the most recent physical inventory to the financial statement

date. The accrual for estimated inventory shrinkage is based on the trailing twelve-month actual inventory

shrinkage rate and can fluctuate from period to period based on the timing of the physical inventory counts.

Stores conduct a physical inventory at least annually.

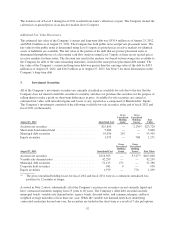

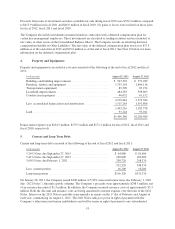

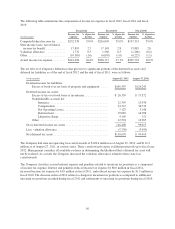

Property and equipment

Property and equipment is stated at cost. Depreciation for financial reporting purposes is calculated using the

straight-line method over the estimated useful lives of the related assets. For leasehold improvements, this

46