Family Dollar 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

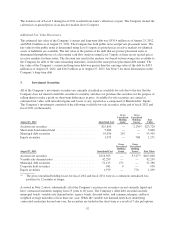

Proceeds from sales of investment securities available-for-sale during fiscal 2012 were $334.9 million compared

to $415.9 million in fiscal 2011 and $46.9 million in fiscal 2010. No gains or losses were realized on those sales

for fiscal 2012, fiscal 2011 and fiscal 2010.

The Company also holds investments in mutual funds in connection with a deferred compensation plan for

certain key management employees. These investments are classified as trading securities and are included, at

fair value, in other assets on the Consolidated Balance Sheets. The Company records an offsetting deferred

compensation liability in Other Liabilities. The fair value of the deferred compensation plan assets was $17.9

million as of the end of fiscal 2012 and $15.6 million as of the end of fiscal 2011. See Note 10 below for more

information on the deferred compensation plan.

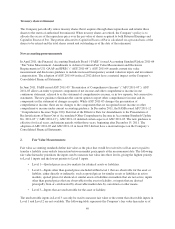

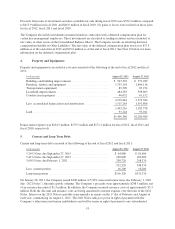

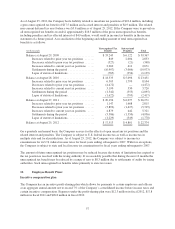

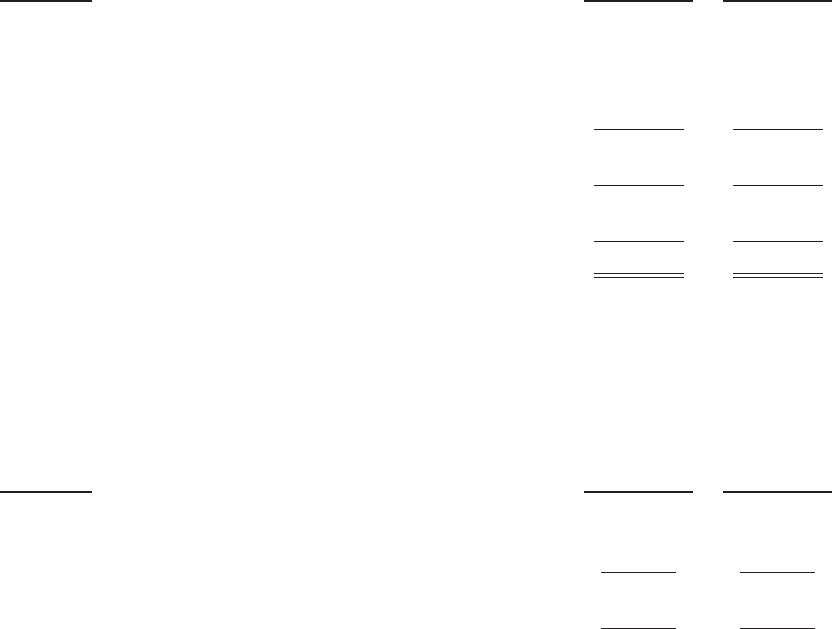

4. Property and Equipment:

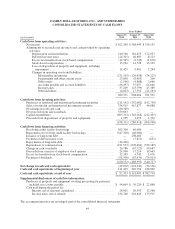

Property and equipment is recorded at cost and consisted of the following at the end of fiscal 2012 and fiscal

2011:

(in thousands) August 25, 2012 August 27, 2011

Buildings and building improvements ......................... $ 543,392 $ 572,039

Furniture, fixtures and equipment ............................ 1,755,154 1,460,116

Transportation equipment .................................. 89,520 87,274

Leasehold improvements ................................... 484,383 398,803

Construction in progress ................................... 46,032 61,152

2,918,481 2,579,384

Less: accumulated depreciation and amortization ................ 1,515,265 1,391,806

1,403,216 1,187,578

Land ................................................... 93,144 93,011

$1,496,360 $1,280,589

Depreciation expense was $204.5 million, $179.5 million and $171.2 million for fiscal 2012, fiscal 2011 and

fiscal 2010, respectively.

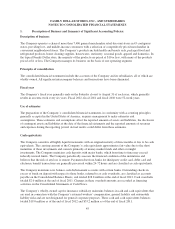

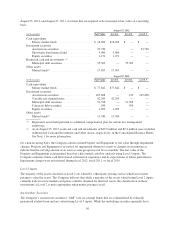

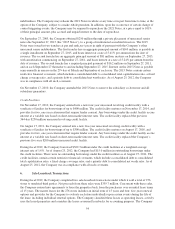

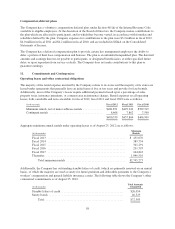

5. Current and Long-Term Debt:

Current and long-term debt consisted of the following at the end of fiscal 2012 and fiscal 2011:

(in thousands) August 25, 2012 August 27, 2011

5.24% Notes due September 27, 2015 ......................... $ 64,800 $ 81,000

5.41% Notes due September 27, 2015 ......................... 169,000 169,000

5.00% Notes due February 1, 2021 ........................... 298,720 298,570

532,520 548,570

Less: current portion ...................................... 16,200 16,200

Long-term portion ........................................ $516,320 $532,370

On January 28, 2011, the Company issued $300 million of 5.00% unsecured senior notes due February 1, 2021

(the “2021 Notes”), through a public offering. The Company’s proceeds were approximately $298.5 million, net

of an issuance discount of $1.5 million. In addition, the Company incurred issuance costs of approximately $3.3

million. Both the discount and issuance costs are being amortized to interest expense over the term of the 2021

Notes. Interest on the 2021 Notes is payable semi-annually in arrears on the 1st day of February and August of

each year, commencing on August 1, 2011. The 2021 Notes rank pari passu in right of payment with the

Company’s other unsecured senior indebtedness and will be senior in right of payment to any subordinated

53