Family Dollar 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Treasury share retirement

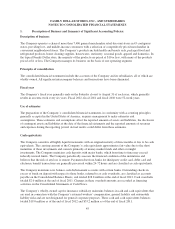

The Company periodically retires treasury shares that it acquires through share repurchases and returns those

shares to the status of authorized but unissued. When treasury shares are retired, the Company’s policy is to

allocate the excess of the repurchase price over the par value of shares acquired to both Retained Earnings and

Capital in Excess of Par. The portion allocated to Capital in Excess of Par is calculated on a pro-rata basis of the

shares to be retired and the total shares issued and outstanding as of the date of the retirement.

New accounting pronouncements

In April 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update 2011-04

“Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements in U.S. GAAP and IFRSs” (“ASU 2011-04”). ASU 2011-04 amends current fair value

measurement and disclosure guidance to include increased transparency around valuation inputs and investment

categorization. The adoption of ASU 2011-04 in fiscal 2012 did not have a material impact on the Company’s

Consolidated Financial Statements.

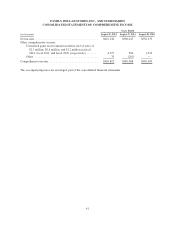

In June 2011, FASB issued ASU 2011-05 “Presentation of Comprehensive Income” (“ASU 2011-05”). ASU

2011-05 allows an entity to present components of net income and other comprehensive income in one

continuous statement, referred to as the statement of comprehensive income, or in two separate, but consecutive

statements. The new guidance eliminates the current option to report other comprehensive income and its

components in the statement of changes in equity. While ASU 2011-05 changes the presentation of

comprehensive income, there are no changes to the components that are recognized in net income or other

comprehensive income under current accounting guidance. In December 2011, the FASB issued ASU 2011-12

“Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of

Reclassifications of Items Out of Accumulated Other Comprehensive Income in Accounting Standards Update

No. 2011-05” (“ASU 2011-12”). ASU 2011-12 deferred certain aspects of ASU 2011-05. The new guidance is

effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The

adoption of ASU 2011-05 and ASU 2011-12 in fiscal 2012 did not have a material impact on the Company’s

Consolidated Financial Statements.

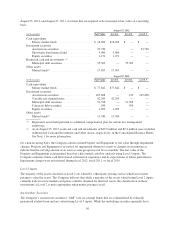

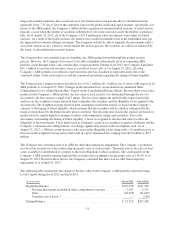

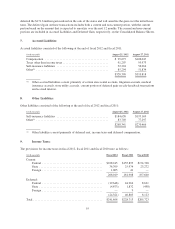

2. Fair Value Measurements:

Fair value accounting standards define fair value as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date. The following

fair value hierarchy prioritizes the inputs used to measure fair value into three levels, giving the highest priority

to Level 1 inputs and the lowest priority to Level 3 inputs.

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly, such as quoted prices for similar assets or liabilities in active

markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs

other than quoted prices that are observable for the asset or liability, or inputs that are derived

principally from or corroborated by observable market data by correlation or other means.

• Level 3—Inputs that are unobservable for the asset or liability.

The unobservable inputs in Level 3 can only be used to measure fair value to the extent that observable inputs in

Level 1 and Level 2 are not available. The following table represents the Company’s fair value hierarchy as of

49