Family Dollar 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

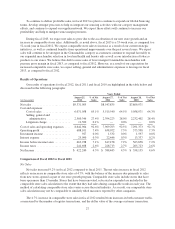

as of the end of fiscal 2012, and $26.3 million as of the end of fiscal 2011. There were no material changes in the

estimates or assumptions used to determine contingent income tax liabilities during fiscal 2012. See Note 9 to the

Consolidated Financial Statements included in this Report for more information on our contingent income tax

liabilities.

Contingent Legal Liabilities:

We are involved in numerous legal proceedings and claims. Our accruals, if any, related to these

proceedings and claims are based on a determination of whether or not the loss is both probable and estimable.

We review outstanding claims and proceedings with external counsel to assess probability and estimates of loss.

We re-evaluate the claims and proceedings each quarter or as new and significant information becomes available,

and we adjust or establish accruals, if necessary. If circumstances change, we may be required to record

adjustments that could be material to our reported financial condition and results of operations. Our total legal

liabilities were not material as of the end of fiscal 2012 or fiscal 2011. There were no material changes in the

estimates or assumptions used to determine contingent legal liabilities during fiscal 2012. See Note 11 to the

Consolidated Financial Statements included in this Report for more information on our contingent legal

liabilities.

Stock-based Compensation Expense:

We measure stock-based compensation expense based on the estimated fair value of the award on the grant

date. The determination of the fair value of our employee stock options on the grant date is calculated using a

Black-Scholes option-pricing model and is affected by our stock price as well as by assumptions regarding a

number of complex and subjective variables. These variables include, but are not limited to, the expected stock

price volatility over the term of the awards, and actual and projected employee stock option exercise behaviors.

We also grant performance share rights and adjust compensation expense each quarter based on the ultimate

number of shares expected to be issued. If factors change and we employ different assumptions to measure stock-

based compensation in future periods, the compensation expense recorded may differ significantly from the

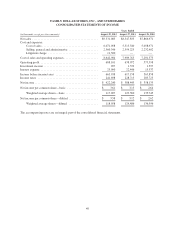

amount recorded in the current period. Our results for fiscal 2012, fiscal 2011 and fiscal 2010 include stock-

based compensation expense of $15.9 million, $14.7 million and $15.7 million, respectively. There were no

material changes in the estimates or assumptions used to determine stock-based compensation during fiscal 2012.

See Note 12 to the Consolidated Financial Statements included in this Report for more information on stock-

based compensation.

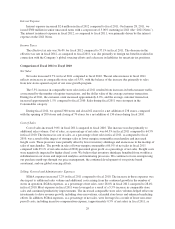

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

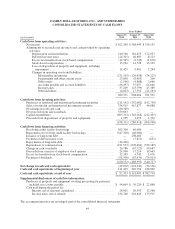

We are subject to market risk from exposure to changes in interest rates based on our financing, investing

and cash management activities. We maintain unsecured revolving credit facilities at variable rates of interest to

meet the short-term needs of our expansion program and seasonal inventory increases. We performed a

sensitivity analysis assuming a hypothetical 100 basis point movement in interest rates applied to the average

daily borrowings under our credit facility. As of August 25, 2012, the analysis indicated that such a movement

would not have a material impact on our financial position, results of operations or cash flows. During fiscal

2012 and fiscal 2011, we incurred an immaterial amount of interest expense related to our credit facilities.

We are also subject to market risk from exposure to changes in the fair value of our investment securities.

Our investment securities currently include auction rate securities that are subject to failed auctions and are not

currently liquid. As of August 25, 2012, we had a $2.1 million unrealized loss ($1.3 million net of taxes) related

to these investments. We believe that we will be able to liquidate our auction rate securities at par at some point

in the future as a result of issuer calls or refinancings, repurchases by the broker dealers, or upon maturity.

However, volatility in the credit markets could continue to negatively impact the timing of future liquidity related

to these investments and lead to additional adjustments to their carrying value. See Note 2 to the Consolidated

Financial Statements included in this Report for more information.

37