Energizer 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Energizer Holdings, Inc. 2007 Annual Report

for an increasingly mobile, techno-centric population

and the proliferation of electronic gadgets that drives

their lives. Our Energizer®e2®Lithium®cells deliver

the stable, long-lasting power preferred by today’s high-

drain digital devices. Our compact, lithium-powered

Energi To Go®chargers deliver on-the-go hybrid power

to cell phones and iPod®devices. Our top-selling

rechargeable batteries and innovative chargers are

designed specifically to match consumers’ busy

lifestyles. And we are in the forefront of bringing effi-

cient LED technology to portable lighting products.

In our wet shave business, we continue to build on

our successful Schick®Quattro®and Intuition®systems

with innovative extensions like the Quattro®Dispos-

able, the world’s first premium four-blade disposable

razor; the upcoming Quattro®Titanium Trimmer, the

only razor that shaves, edges and trims; and advanced

Intuition Plus®with an improved ergonomic handle

and pivoting head.

Playtex Acquisition

Consistent with our long-term strategy and our priorities

for the use of cash flow, we acquired Playtex Products,

Inc. effective October 1, 2007 for approximately $1.9

billion, of which $1.6 billion was financed with new

debt. For the 12 months ended September 30, 2007,

Playtex generated total pro forma sales of $773 million,

approximately 92 percent of which are generated in

North America. Playtex is a leading consumer products

company with a portfolio of well-known brands, most

with No. 1 or No. 2 market positions, in three categories

– skin care, feminine care and infant care.

Fit with Energizer. We view Playtex as a terrific fit with

Energizer’s culture, businesses and growth strategies.

Playtex has strong brands in stable or growing personal

care categories adjacent to categories where we currently

compete, with particular strengths and opportunities

with the target audience of female consumers. Its prod-

ucts enjoy healthy margins with strong, predictable cash

flows similar to our existing household and personal

grooming products. We share similar customers and dis-

tribution channels in the United States and Canada. And

we are adding a strong, seasoned management team and

skilled colleagues. We believe Playtex will add significant

value to Energizer, innovating in the categories in which

it competes, selectively expanding into global markets

using our distribution network, and achieving synergistic

savings as we integrate our businesses.

With the addition of Playtex, Energizer has a more

diversified portfolio of branded products and greater

scale in the personal care category, now more evenly

balanced with our household goods business. As such,

we are restructuring the company into the Household

Products Division (Energizer®and Eveready®) and the

Personal Care Division (Schick-Wilkinson Sword and

Playtex Products), and going forward, we will report

business and financial results in those two segments.

Share Repurchase

In returning cash to shareholders, we continue to favor

opportunistic share repurchase over dividends, giving

us greater operating and financial flexibility. During

fiscal 2007, the company bought back 0.8 million

shares of its common stock for $53 million. Since our

2000 spin-off, we have repurchased 48 percent of the

original shares outstanding – a total of 46.2 million

shares for $2.0 billion at an average price of $42.72,

well below current market prices. Near term, however,

our priority is debt repayment, which increased as a

result of the acquisition of Playtex Products.

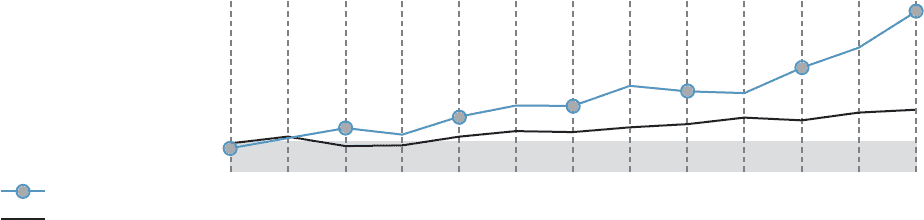

Stock Price Performance

OCT 01

OCT 02

OCT 03

OCT 04

OCT 05

OCT 06

OCT 07

The cumulative total return

on $100 invested in Energizer

Holdings, Inc. from the first

day of trading on April 3, 2000

($21.25 per share closing stock

price) through September 28,

2007 ($110.85 per share closing

stock price) reached 422 percent

versus 80 percent for the S&P

MidCap 400 Index.

Energizer

S&P MidCap 400

$500

$400

$300

$200

$100

0