Energizer 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Energizer Holdings, Inc. 2007 Annual Report

Rights, however, may only be exercised if a person or group has

acquired, or commenced a public tender for 20% or more of the

outstanding ENR stock, unless the acquisition is pursuant to a ten-

der or exchange offer for all outstanding shares of ENR stock and

a majority of the Board of Directors determines that the price and

terms of the offer are adequate and in the best interests of share-

holders (a Permitted Offer). At the time that 20% or more of the

outstanding ENR stock is actually acquired (other than in connec-

tion with a Permitted Offer), the exercise price of each Right will

be adjusted so that the holder (other than the person or member

of the group that made the acquisition) may then purchase a share

of ENR stock at one-third of its then-current market price. If the

Company merges with any other person or group after the Rights

become exercisable, a holder of a Right may purchase, at the exer-

cise price, common stock of the surviving entity having a value

equal to twice the exercise price. If the Company transfers 50% or

more of its assets or earnings power to any other person or group

after the Rights become exercisable, a holder of a Right may pur-

chase, at the exercise price, common stock of the acquiring entity

having a value equal to twice the exercise price.

The Company can redeem the Rights at a price of $0.01 per

Right at any time prior to the time a person or group actually

acquires 20% or more of the outstanding ENR stock (other than in

connection with a Permitted Offer). In addition, following the

acquisition by a person or group of at least 20%, but not more than

50% of the outstanding ENR stock (other than in connection with

a Permitted Offer), the Company may exchange each Right for

one share of ENR stock. The Company’s Board of Directors may

amend the terms of the Rights at any time prior to the time a per-

son or group acquires 20% or more of the outstanding ENR stock

(other than in connection with a Permitted Offer) and may amend

the terms to lower the threshold for exercise of the Rights. If the

threshold is reduced, it cannot be lowered to a percentage that is

less than 10% or, if any shareholder holds 10% or more of the out-

standing ENR stock at that time, the reduced threshold must be

greater than the percentage held by that shareholder. The Rights

will expire on April 1, 2010.

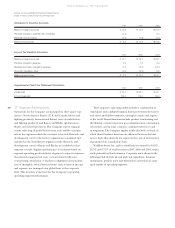

At September 30, 2007, there were 300 million shares of ENR

stock authorized, of which approximately 3.4 million shares were

reserved for issuance under the 2000 Incentive Stock Plan.

Beginning in September 2000, the Company’s Board of

Directors has approved a series of resolutions authorizing the

repurchase of shares of ENR common stock, with no commitments

by the Company to repurchase such shares. On July 24, 2006, the

Board of Directors approved the repurchase of up to an additional

10 million shares and 8.0 million shares remain under such author-

ization as of September 30, 2007. During fiscal year 2007, approxi-

mately 0.8 million shares were purchased for $53.0.

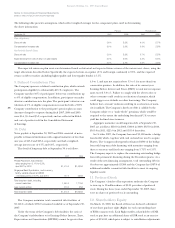

13. Financial Instruments and Risk Management

Foreign Currency Contracts At times, the Company enters into

foreign exchange forward contracts and, to a lesser extent, pur-

chases options and enters into zero-cost option collars to mitigate

potential losses in earnings or cash flows on foreign currency trans-

actions. The Company has not designated any financial instruments

as hedges for accounting purposes. Foreign currency exposures are

primarily related to anticipated intercompany purchase transac-

tions and intercompany borrowings. Other foreign currency

transactions to which the Company is exposed include external

purchase transactions and intercompany receivables, dividends

and service fees.

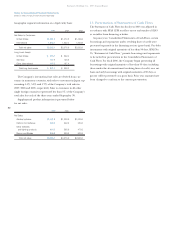

The contractual amounts of the Company’s forward exchange

contracts were $67.1 and $21.3 in 2007 and 2006, respectively.

These contractual amounts represent transaction volume outstand-

ing and do not represent the amount of the Company’s exposure

to credit or market loss. Foreign currency contracts are generally

for one year or less.

Derivative Securities The Company uses raw materials that are

subject to price volatility. Hedging instruments are used by the

Company as it desires to reduce exposure to variability in cash flows

associated with future purchases of zinc or other commodities.

These hedging instruments are accounted for under FAS 133 as

cash flow hedges. At September 30, 2007, the fair market value of

the Company’s outstanding hedging instruments was an unrealized

pre-tax loss of $15.3. Realized gains and losses are reflected as

adjustments to the cost of the raw materials. Over the next 12

months, approximately $13.4 of the loss recognized in

Accumulated Other Comprehensive Income will be recognized in

earnings. For hedge ineffectiveness, losses of $0.5 were recorded

directly to Cost of Products Sold during the current fiscal year.

Contract maturities for these hedges extend into fiscal year 2009.

During the current year, the Company discontinued hedge

accounting treatment for some of its contracts, most of which were

settled or unwound during the current fiscal year. These contracts

no longer met the accounting requirements of a cash flow hedge

because it was probable that the original forecasted transactions

will not occur by the end of the originally specified time period.

The pre-tax losses on these hedges of $2.5 were recorded in Cost of

Products Sold.

Prepaid Share Options A portion of the Company’s deferred com-

pensation liabilities is based on Company stock price and is subject

to market risk. The Company has entered into a net-cash settled

prepaid share option transaction with a financial institution to miti-

gate this risk. The change in fair value of the prepaid share options

is recorded in SG&A in the Consolidated Statements of Earnings.

Changes in value of the prepaid share option approximately offset

the after-tax changes in the deferred compensation liabilities tied

to the Company’s stock price. Market value of the Company’s

investment in the prepaid share options was $59.3 and $50.8 at

September 30, 2007 and 2006, respectively, with approximately 0.5

and 0.7 million prepaid share options outstanding at September 30,

2007 and 2006, respectively. The settlement date of the options

outstanding at 2007 year-end is September 30, 2008. The change

in fair value of the prepaid share option for the year ended