Energizer 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Energizer Holdings, Inc. 2007 Annual Report

September 30, 2007 and 2006 resulted in income of $23.2 and

$10.8, respectively.

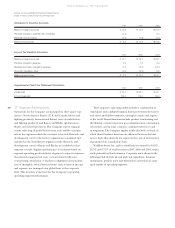

Concentration of Credit Risk The counterparties to foreign cur-

rency contracts consist of a number of major international financial

institutions and are generally institutions with which the Company

maintains lines of credit. The Company does not enter into foreign

exchange contracts through brokers nor does it trade foreign

exchange contracts on any other exchange or over-the-counter

markets. Risk of currency positions and mark-to-market valuation

of positions are strictly monitored at all times.

The Company continually monitors positions with, and credit

ratings of, counterparties both internally and by using outside rat-

ing agencies. The Company has implemented policies that limit the

amount of agreements it enters into with any one party. While non-

performance by these counterparties exposes the Company to

potential credit losses, such losses are not anticipated due to the

control features mentioned.

The Company sells to a large number of customers primarily in

the retail trade, including those in mass merchandising, drugstore,

supermarket and other channels of distribution throughout the

world. The Company performs ongoing evaluations of its cus-

tomers’ financial condition and creditworthiness, but does not

generally require collateral. The Company’s largest customer

had obligations to the Company with a carrying value of $91.1

at September 30, 2007. While the competitiveness of the retail

industry presents an inherent uncertainty, the Company does

not believe a significant risk of loss from a concentration of credit

risk exists with respect to accounts receivable.

Financial Instruments The Company’s financial instruments

include cash and cash equivalents, short-term and long-term debt

and foreign currency contracts. Due to the nature of cash and cash

equivalents and short-term borrowings, including notes payable, car-

rying amounts on the balance sheet approximate fair value.

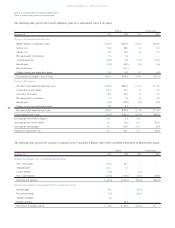

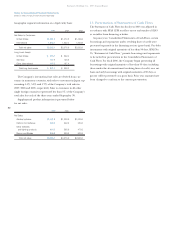

At September 30, 2007 and 2006, the fair market value of fixed

rate long-term debt was $1,423.1 and $1,454.8, respectively, com-

pared to its carrying value of $1,475.0 and $1,485.0, respectively.

The book value of the Company’s variable rate debt approximates

fair value. The fair value of the long-term debt is estimated using

yields obtained from independent pricing sources for similar types

of borrowing arrangements.

The fair value of foreign currency contracts is the amount that

the Company would receive or pay to terminate the contracts, con-

sidering first, quoted market prices of comparable agreements, or in

the absence of quoted market prices, such factors as interest rates,

currency exchange rates and remaining maturities. Based on these

considerations, the Company would make an insignificant payment

for outstanding foreign currency contracts at September 30, 2007

and 2006. However, these payments are unlikely due to the fact that

the Company enters into foreign currency contracts to hedge identi-

fiable foreign currency exposures, and as such would generally not

terminate such contracts.

14. Environmental and Legal Matters

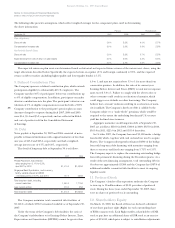

Government Regulation and Environmental Matters The opera-

tions of the Company, like those of other companies engaged in the

battery and wet shaving products businesses, are subject to various

federal, state, foreign and local laws and regulations intended to

protect the public health and the environment. These regulations

primarily relate to worker safety, air and water quality, underground

fuel storage tanks and waste handling and disposal. The Company

has received notices from the U.S. Environmental Protection

Agency, state agencies and/or private parties seeking contribution,

that it has been identified as a “potentially responsible party” (PRP)

under the Comprehensive Environmental Response, Compensation

and Liability Act, and may be required to share in the cost of

cleanup with respect to seven federal “Superfund” sites. It may also

be required to share in the cost of cleanup with respect to two state-

designated sites or other sites outside of the U.S.

Accrued environmental costs at September 30, 2007 were $12.5,

of which $2.6 is expected to be spent in fiscal 2008. This accrual is

not measured on a discounted basis. It is difficult to quantify with

certainty the cost of environmental matters, particularly remediation

and future capital expenditures for environmental control equip-

ment. Nevertheless, based on information currently available, the

Company believes the possibility of material environmental costs in

excess of the accrued amount is remote.

Legal Proceedings The Company and its subsidiaries are parties to a

number of legal proceedings in various jurisdictions arising out of the

operations of its businesses. Many of these legal matters are in prelimi-

nary stages and involve complex issues of law and fact, and may pro-

ceed for protracted periods of time. The amount of liability, if any,

from these proceedings cannot be determined with certainty.

However, based upon present information, the Company believes that

its ultimate liability, if any, arising from pending legal proceedings,

asserted legal claims and known potential legal claims which are likely

to be asserted, should not be material to the Company’s financial posi-

tion, taking into account established accruals for estimated liabilities.

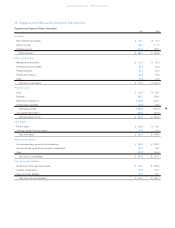

15. Other Commitments and Contingencies

An international affiliate of the Company has $8.3 of funds

deposited in a bank account that is acting as collateral for a certain

bank loan. The Company has reflected this bank deposit as

restricted cash, which is included in other current assets on the

Consolidated Balance Sheet. The loan was initiated in June 2004

for a three month period. At each maturity, the Company renewed

the agreement. As the loan amount changes, the funds on deposit

will be required to increase or decrease with the loan amount.

Beginning in 2006, the impact of this transaction is reflected in

the investing section of the Consolidated Statement of Cash Flows.

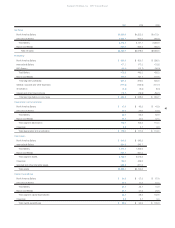

Total rental expense for all operating leases was $28.0, $27.1 and

$26.2 in 2007, 2006 and 2005, respectively. Future minimum rental

commitments under noncancelable operating leases in effect as of

September 30, 2007 were $14.2 in 2008, $11.6 in 2009, $9.5 in 2010,

$6.2 in 2011, $2.8 in 2012 and $9.3 thereafter. These leases are pri-

marily for office facilities.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)