Energizer 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Energizer Holdings, Inc. 2007 Annual Report

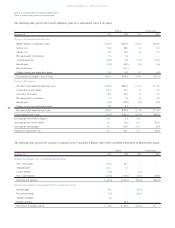

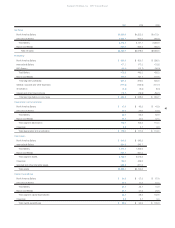

19. Quarterly Financial Information – (Unaudited)

The results of any single quarter are not necessarily indicative of the Company’s results for the full year. Net earnings of the Company are

significantly impacted in the first quarter by the additional battery product sales volume associated with the December holiday season.

First Second Third Fourth

Fiscal 2007

Net sales $959.2 $730.9 $800.0 $875.0

Gross profit 454.2 346.3 378.5 425.7

Net earnings 122.3 66.6 62.5 70.0

Basic earnings per share $ 2.16 $ 1.18 $ 1.10 $ 1.23

Diluted earnings per share $ 2.08 $ 1.14 $ 1.06 $ 1.19

Items increasing/(decreasing) net earnings:

Restructuring and related charges (2.3) (3.0) (2.3) (4.6)

Adjustments to prior years’ tax accruals –– 3.54.4

Deferred tax benefit due to statutory rate change –– –9.7

Foreign benefits related to prior years’ losses –– 4.3–

Fiscal 2006

Net sales $882.4 $629.5 $734.9 $830.1

Gross profit 431.4 307.8 357.4 384.2

Net earnings 120.5 50.0 51.3 39.1

Basic earnings per share $ 1.83 $ 0.81 $ 0.86 $ 0.68

Diluted earnings per share $ 1.77 $ 0.78 $ 0.83 $ 0.66

Items increasing/(decreasing) net earnings:

Restructuring and related charges (3.1) – (7.9) (13.9)

Adjustments to prior years’ tax accruals – – 8.6 2.3

Foreign benefits related to prior years’ losses – – – 5.7

Foreign pension charge – – – (3.7)

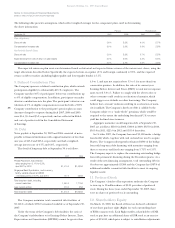

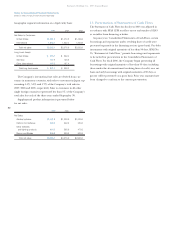

20. Subsequent Event

On October 1, 2007, the Company paid approximately $1,900

for the acquisition of all outstanding Playtex common stock,

repayment or defeasance of outstanding Playtex debt, and other

transaction costs. Playtex is a leading North American manufac-

turer and marketer in the skin, feminine and infant care industries,

with a diversified portfolio of well-recognized branded consumer

products. Total enterprise value of the transaction was financed

through cash and existing and new committed credit facilities. For

further information on debt acquired as a result of this acquisition,

see Note 10.