Energizer 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Looking ahead, we see innovation in our products and

performance in our operations. We see momentum in our

businesses and continued growth in shareholder value.

Financial Performance

For the fiscal year ended September 30, 2007,

Energizer’s net earnings were $321.4 million com-

pared to $260.9 million the prior year and earnings

per share climbed to $5.51 from $4.14 the year before.

Net sales for the year reached a record $3.4 billion,

up from $3.1 billion the previous year.

Growth in earnings per share continued strong and

steady, fueled by the profitability of our operations and

share repurchase program. We are committed to a goal

of at least 10 percent growth in earnings per share and

have consistently surpassed that target with a com-

pounded annual growth rate of 24 percent over the last

six years. Reflecting this consistent growth in earnings per

share, our share price over that period has appreciated

265 percent with a year-end price of $110.85 per share.

From our spin-off through the end of fiscal 2007, a

$100 investment in Energizer would have grown to

$522 at a compounded annual rate of 25 percent com-

pared to 9 percent for the S&P MidCap 400 Index.

Cash flow and priorities. Generating strong, stable cash

flows continues as a major focus as we strive to build our

business, maintain and enhance financial flexibility, and

increase shareholder value. Including free cash flow of

$356.7 million in fiscal 2007, we have generated $2.03

billion in free cash flow since our spin-off in 2000.

Our priorities for the use of cash flow include funding

innovation in our products, acquiring companies and

brands to complement our existing businesses and repur-

chasing shares. Prioritization depends on which uses are

expected to generate the highest shareholder returns.

Last year, we were active and successful on all fronts.

Product Innovation

Innovation in products and technology helps Energizer

better meet the needs of today’s consumers. In our

battery business, we provide portable power solutions

To Our Shareholders:

Fiscal 2007 was another strong year for Energizer Holdings as we overcame

significant challenges, gained momentum and market share, and expanded our

consumer products portfolio with the acquisition of market-leading brands –

achieving double-digit earnings growth and strengthening our businesses. In

just seven full years as a stand-alone company, we have grown into a $2 billion

battery company and $1 billion razor company – and with the addition of Playtex

Products, Inc., we eagerly enter fiscal 2008 as a $4 billion enterprise.

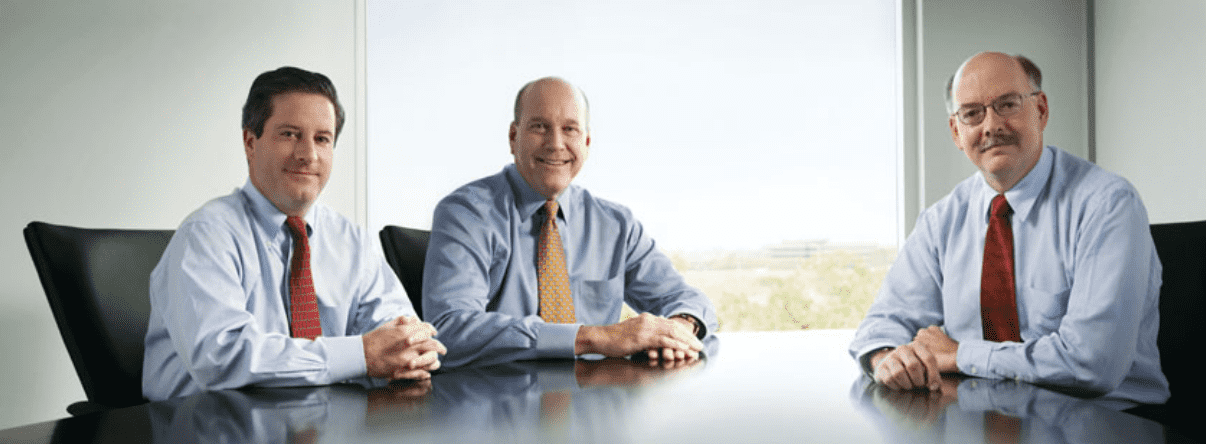

Ward M. Klein

Chief Executive Officer

David P. Hatfield

President and Chief Executive Officer,

Energizer Personal Care

Joseph W. McClanathan

President and Chief Executive Officer,

Energizer Household Products