Energizer 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Energizer Holdings, Inc. 2007 Annual Report

9. Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends

participation eligibility to substantially all U.S. employees. The

Company matches 50% of participants’ before-tax contributions up

to 6% of eligible compensation. In addition, participants can make

after-tax contributions into the plan. The participant’s after-tax con-

tribution of 1% of eligible compensation is matched with a 325%

Company contribution to the participant’s pension plan account.

Amounts charged to expense during fiscal 2007, 2006 and 2005

were $5.6, $5.4 and $5.2, respectively, and are reflected in SG&A

and cost of products sold in the Consolidated Statement

of Earnings.

10. Debt

Notes payable at September 30, 2007 and 2006 consisted of notes

payable to financial institutions with original maturities of less than

one year of $43.0 and $63.6, respectively, and had a weighted-

average interest rate of 6.7% and 6.0%, respectively.

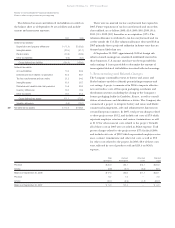

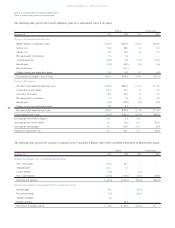

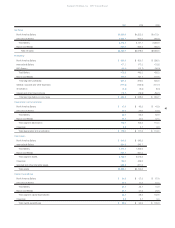

The detail of long-term debt at September 30 is as follows:

2007 2006

Private Placement, fixed interest

rates ranging from 3.1% to 6.2%,

due 2007 to 2016 $1,475.0 $1,485.0

Singapore Bank Syndication, multi-currency

facility, variable interest at LIBOR

+ 80 basis points, or 6.7%, due 2010 107.0 225.0

Total long-term debt, including

current maturities 1,582.0 1,710.0

Less current portion 210.0 85.0

Total long-term debt $1,372.0 $1,625.0

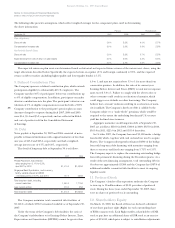

The Company maintains total committed debt facilities of

$2,140.0, of which $558.0 remained available as of September 30,

2007.

Under the terms of the Company’s debt facilities, the ratio of

the Company’s indebtedness to its Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA) cannot be greater than

4.0 to 1, and may not remain above 3.5 to 1 for more than four

consecutive quarters. In addition, the ratio of its current year

Earnings Before Interest and Taxes (EBIT) to total interest expense

must exceed 3.0 to 1. Failure to comply with the above ratios or

other covenants could result in acceleration of maturity, which

could trigger cross defaults on other borrowings. The Company

believes that covenant violations resulting in acceleration of matu-

rity is unlikely. The Company’s fixed rate debt is callable by the

Company, subject to a “make whole” premium, which would be

required to the extent the underlying benchmark U.S. treasury

yield has declined since issuance.

Aggregate maturities on all long-term debt at September 30,

2007 are as follows: $210.0 in 2008, $100.0 in 2009, $327.0 in 2010,

$165.0 in 2011, $225.0 in 2012 and $555.0 thereafter.

In October 2007, the Company borrowed $1,500 under a bridge

loan facility which, together with cash on hand was used to acquire

Playtex. The Company subsequently refinanced $890 of the bridge

loan with long-term debt financing, with maturities ranging from

three to ten years and fixed rates ranging from 5.71% to 6.55%.

The Company expects to replace the remaining outstanding bridge

loan with permanent financing during the December quarter. As a

result of the new financing arrangement, total outstanding debt in

October was approximately $3,300 and the Company has $387.0 of

additional available committed debt facilities to meet its ongoing

liquidity needs.

11. Preferred Stock

The Company’s Articles of Incorporation authorize the Company

to issue up to 10 million shares of $0.01 par value of preferred

stock. During the three years ended September 30, 2007, there

were no shares of preferred stock outstanding.

12. Shareholders Equity

On March 16, 2000, the Board of Directors declared a dividend

of one share purchase right (Right) for each outstanding share

of ENR common stock. Each Right entitles a shareholder of ENR

stock to purchase an additional share of ENR stock at an exercise

price of $150.00, which price is subject to anti-dilution adjustments.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

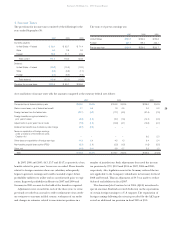

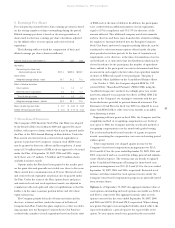

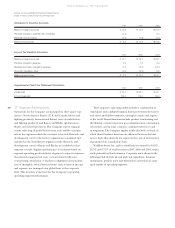

The following table presents assumptions, which reflect weighted-averages for the component plans, used in determining

the above information:

Pension Postretirement

September 30, 2007 2006 2007 2006

Plan obligations:

Discount rate 5.8% 5.3% 6.0% 5.7%

Compensation increase rate 3.9% 3.8% 3.5% 3.6%

Net Periodic Benefit Cost:

Discount rate 5.3% 5.2% 5.7% 5.5%

Expected long-term rate of return on plan assets 8.0% 8.0% 5.5% 5.5%

Compensation increase rate 3.8% 3.7% 3.6% 3.5%

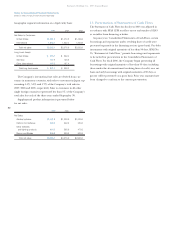

The expected return on plan assets was determined based on historical and expected future returns of the various asset classes, using the

target allocations described below. Specifically, the expected return on equities (U.S. and foreign combined) is 9.6%, and the expected

return on debt securities (including higher-quality and lower-quality bonds) is 5.1%.