Energizer 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Energizer Holdings, Inc. 2007 Annual Report

products), International Battery (rest of world battery and lighting

products) and Razors and Blades (global razors, blades and related

products). The Company reports segment results reflecting all profit

derived from each outside customer sale in the region in which the

customer is located. Research and development costs for the battery

segments are combined and included in the Total Battery segment

results. Research and development costs for Razors and Blades are

included in that segment’s results. Segment performance is evaluated

based on segment operating profit exclusive of general corporate

expenses, share-based compensation costs, costs associated with most

restructuring, integration or business realignment activities and

amortization of intangible assets. Financial items, such as interest

income and expense, are managed on a global basis at the corporate

level. This structure is the basis for the Company’s reportable operat-

ing segment information presented in Note 17 to the Consolidated

Financial Statements.

The Company’s operating model includes a combination of stand-

alone and combined business functions between the battery and

razors and blades businesses, varying by country and region of the

world. Shared functions include product warehousing and distribu-

tion, various transaction processing functions and environmental

activities, and in some countries, combined sales forces and manage-

ment. Such allocations do not represent the costs of such services if

performed on a stand-alone basis. The Company applies a fully allo-

cated cost basis, in which shared business functions are allocated

between the businesses.

Beginning in the first fiscal quarter of 2008, and as a result of the

Playtex acquisition and subsequent realignment of management

responsibilities, the Company will report results of two segments: the

Household Products segment, which will include global batteries and

lighting products, and the Personal Care segment, which will include

global wet shave, skin care, feminine care and infant care.

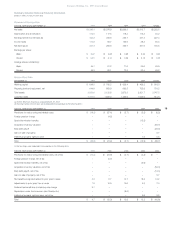

North America Battery

2007 2006 2005

Net sales $1,330.6 $1,233.8 $1,173.1

Segment profit $ 330.5 $ 300.7 $ 295.8

For the year ended September 30, 2007, sales increased $96.8, or

8%, primarily due to favorable pricing and product mix of $54.8 and

higher sales volume of $38.1. Fiscal 2007 benefited from price

increases implemented in both 2006 and 2007 in response to signifi-

cant increases in material costs. For the current year, Energizer MAX

unit sales were flat reflecting soft volume in the overall premium

alkaline battery segment of the category, partially due to virtually no

hurricane-related consumption. Lithium and rechargeable battery

units grew in excess of 30%. Canadian currency translation favorably

impacted sales by $3.9.

Gross profit increased $49.9 in 2007 as higher sales were partially

offset by higher product costs, primarily due to the increased cost of

zinc. Product cost in the current year was unfavorable $33.9 com-

pared to the same period last year as material cost increases of

$49.7 were partially offset by other cost reductions. Segment profit

increased $29.8, or 10%, as higher gross profit was partially offset by

higher advertising, promotion and selling expenses.

For the year ended September 30, 2006, sales increased $60.7, or

5%, virtually all due to higher volume. Energizer MAX volume for the

year increased 4% as higher general demand was partially offset by

a decline in hurricane-related battery sales. Fiscal 2006 had approxi-

mately $5 of hurricane-related sales compared to approximately $21

in 2005. High performance lithium and rechargeable battery volume

grew more than 40%. Battery charger sales were up more than 50%,

including the launch of our new Energi To Go cell phone charger line.

For our portfolio of lower priced products, which includes carbon zinc

and Eveready Gold alkaline batteries, volume declined 2% in 2006.

Overall pricing and product mix were unfavorable $7.6 in 2006 as

higher list prices, particularly in the latter portion of the year, were

more than offset by a continuing shift to trade channels that feature

larger package sizes with lower per unit prices. Canadian currency

translation favorably impacted sales by $6.1 in 2006 compared to 2005.

Gross profit dollars increased $10.9 in 2006 as contribution from

higher sales was partially offset by $16.7 of unfavorable product costs.

Material and distribution costs were unfavorable $20, with zinc cost

increases accounting for the vast majority of the total. Segment profit

increased $4.9, as higher gross profit was partially offset by higher

A&P and general and administrative expenses.

International Battery

2007 2006 2005

Net sales $1,045.7 $913.3 $885.9

Segment profit $ 177.7 $177.3 $178.5

For the year ended September 30, 2007, net sales increased

$132.4, or 14%, with favorable currency accounting for $45.3 of the

increase. On a constant currency basis, sales increased 10%, as higher

volumes in all areas contributed $73.5 and overall pricing and prod-

uct mix was favorable $13.6. The volume contribution reflects double

digit unit growth rates for branded alkaline, rechargeable and

lithium batteries, while carbon zinc units declined. Price increases in

a number of markets in response to material cost increases were par-

tially offset by unfavorable product mix, primarily in Europe.

Gross profit increased $32.9 in absolute dollars, but declined $5.1

on a constant currency basis, as the contribution from higher volume

and pricing was more than offset by $49.4 of unfavorable product

cost, primarily due to material costs. Segment profit was essentially

flat in absolute dollars but declined $26.2 excluding currency impacts

due to higher SG&A and A&P expenses in addition to the gross

profit impact.

For the year ended September 30, 2006, net sales increased $27.4,

or 3%. Excluding currency impacts, International Battery sales

increased $38.3, or 4%, on higher volume partially offset by unfavor-

able pricing and product mix, primarily in Europe. An extremely

competitive European pricing environment, combined with sales

shifting to larger package sizes that sell at lower per unit prices,

accounted for the unfavorable pricing.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)