Energizer 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Energizer Holdings, Inc. 2007 Annual Report

is callable by the Company, subject to a “make whole” premium,

which would be required to the extent the underlying benchmark

U.S. treasury yield has declined since issuance.

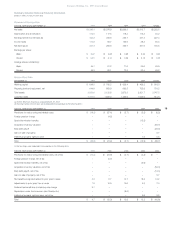

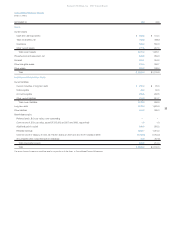

The Company purchased shares of its common stock as follows

(shares in millions):

Total

Average

Fiscal Year Shares Cost Price

2007 0.8 $ 53.0 $67.67

2006 11.3 $600.7 $53.02

2005 8.1 $457.4 $56.37

The Company has 8.0 million shares remaining on the current

authorization from its Board of Directors to repurchase its common

stock in the future. Future purchases may be made from time to time

on the open market or through privately negotiated transactions, sub-

ject to corporate objectives and the discretion of management.

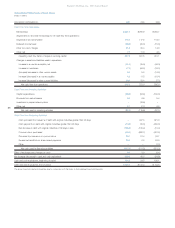

A summary of the Company’s significant contractual obligations at

September 30, 2007 is shown below, and excludes the impact of the

Playtex acquisition:

Less More

Than 1-3 3-5 Than

Total 1 Year Years Years 5 Years

Long-term debt,

including current

maturities $1,582.0 $210.0 $567.0 $250.0 $555.0

Interest on

long-term debt 377.8 78.4 129.0 89.5 80.9

Operating leases 53.6 14.2 21.1 9.0 9.3

Total $2,013.4 $302.6 $717.1 $348.5 $645.2

The Company has contractual purchase obligations for future

purchases, which generally extend one to three months. These obli-

gations are primarily purchase orders at fair value that are part of the

normal operations and are reflected in historical operating cash flow

trends. In addition, the Company has various commitments related to

service and supply contracts that contain penalty provisions for early

termination. As of September 30, 2007, we do not believe such pur-

chase obligations or termination penalties will have a significant

effect on our results of operations, financial position or liquidity posi-

tion in the future.

The Company believes that, prior to and following the acquisition

of Playtex, cash flows from operating activities and periodic borrow-

ings will be adequate to meet short-term and long-term liquidity

requirements prior to the maturity of the Company’s credit facilities,

although no guarantee can be given in this regard.

Market Risk Sensitive Instruments

and Positions

The market risk inherent in the Company’s financial instruments and

positions represents the potential loss arising from adverse changes in

currency rates, commodity prices, interest rates and stock price. The

following risk management discussion and the estimated amounts

generated from the sensitivity analyses are forward-looking statements

of market risk assuming certain adverse market conditions occur.

Company policy allows derivatives to be used only for identifiable

exposures and, therefore, the Company does not enter into hedges

for trading purposes where the sole objective is to generate profits.

Currency Rate Exposure The Company generally views its invest-

ments in foreign subsidiaries with a functional currency other than

the U.S. dollar as long-term. As a result, the Company does not gen-

erally hedge these net investments. Capital structuring techniques

are used to manage the net investment in foreign currencies as nec-

essary. Additionally, the Company attempts to limit its U.S. dollar

net monetary liabilities in countries with unstable currencies.

From time to time the Company may employ foreign currency

hedging techniques to mitigate potential losses in earnings or cash

flows on foreign currency transactions, which primarily consist of

anticipated intercompany purchase transactions and intercompany

borrowings. External purchase transactions and intercompany divi-

dends and service fees with foreign currency risk may also be

hedged. The primary currencies to which the Company’s foreign

affiliates are exposed include the U.S. dollar, the euro, the yen and

the British pound.

In addition, the Company has investments in Venezuela, which

currently require government approval to convert local currency to

U.S. dollars at official government rates. Recently, government

approval for currency conversion to satisfy U.S. dollar liabilities to

foreign suppliers has been delayed, resulting in higher cash bal-

ances and higher past due U.S. dollar payables within our

Venezuelan subsidiary. If the Company was forced to settle its

Venezuelan subsidiary’s U.S. dollar liabilities using unofficial, paral-

lel currency exchange mechanisms as of September 30, 2007, it

would result in a currency exchange loss of approximately $32.

The Company uses natural hedging techniques, such as offset-

ting like foreign currency cash flows, foreign currency derivatives

with durations of generally one year or less including forward

exchange contracts, purchased put and call options and zero-cost

option collars. The Company has not designated any of these types

of financial instruments as hedges for accounting purposes in the

three years ended September 30, 2007.

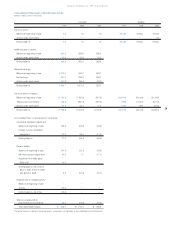

The Company’s foreign currency derivative contracts outstanding

at year-end hedge existing balance sheet exposures. Any losses on

these contracts would be fully offset by exchange gains on the under-

lying exposures, thus they are not subject to significant market risk.

The contractual amounts of the Company’s forward exchange con-

tracts and purchased currency options in U.S. dollar equivalents

were $67.1 and $21.3 at September 30, 2007 and 2006, respectively.

Commodity Price Exposure The Company uses raw materials that

are subject to price volatility. The Company will use hedging instru-

ments as it desires to reduce exposure to variability in cash flows asso-

ciated with future purchases of zinc or other commodities. These

hedging instruments are accounted for as cash flow hedges. At

September 30, 2007, the fair market value of the Company’s out-

standing hedging instruments was an unrealized pre-tax loss of $15.3.

Contract maturities for these hedges extend into fiscal year 2009.