Energizer 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Energizer Holdings, Inc. 2007 Annual Report

U.S. Playtex is a leading North American manufacturer and marketer

in the skin, feminine and infant care industries, with a diversified

portfolio of well-recognized branded consumer products.

As a result of the Playtex acquisition, the Company’s total debt is

just under $3,300 with a blended interest rate of 5.6%. We expect

our future effective tax rate to be approximately one percentage point

higher as a result of the Playtex acquisition. This increase reflects the

concentration of Playtex profits in the U.S., which has a higher tax

rate than our historical average. In addition to the other impacts from

the Playtex acquisition, our results for the December and March

quarters will be negatively impacted by an inventory write-up necessary

under purchase accounting rules. The Company will begin reporting

results of Playtex operations as of the beginning of fiscal 2008.

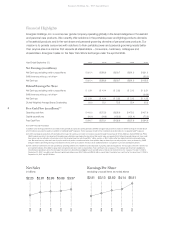

Financial Results

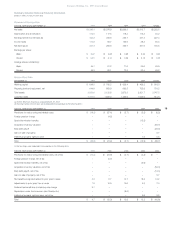

Net earnings for the year ended September 30, 2007 were $321.4

compared to $260.9 in 2006 and $280.7 in 2005. Basic and diluted

earnings per share in 2007 were $5.67 and $5.51, respectively, com-

pared to $4.26 and $4.14 in 2006 and $3.95 and $3.82 in 2005.

Current year net earnings include the following items, stated

on an after-tax basis:

favorable adjustments to deferred tax balances and prior years’ tax

accruals and previously unrecognized tax benefits related to foreign

losses of $21.9, or $0.37 per diluted share, partially offset by

charges of $12.2, or $0.21 per diluted share, related to European

restructuring programs.

Fiscal 2006 net earnings included the following items, stated on

an after-tax basis:

charges of $24.9, or $0.39 per diluted share, related to European

restructuring programs,

a charge of $3.7, or $0.06 per diluted share, to record the cumulative

amount of foreign pension costs that should have been previously

recognized and

favorable adjustments to prior years’ tax accruals and previously

unrecognized tax benefits related to foreign losses of $16.6,

or $0.26 per diluted share.

Fiscal 2005 net earnings included the following, stated on

an after-tax basis:

tax benefits totaling $25.3, or $0.34 per diluted share, related

to tax loss benefits and adjustments to prior year tax accruals,

partially offset by,

a $9.0, or $0.12 per diluted share, provision related to repatriation of

foreign earnings under the American Jobs Creation Act and

restructuring charges of $3.7, or $0.05 per diluted share, related to

several individually immaterial restructuring projects.

Operating Results

Net Sales Net sales in 2007 increased $288.2, or 9%, in absolute

dollars, or $212.7, or 7%, on a constant currency basis compared to

2006. All three segments contributed to the increase. Net sales in

2006 increased $87.1, or 3%, in absolute dollars and $110.4, or 4%,

on a constant currency basis compared to 2005. Both the North

America and International Battery segments accounted for the 2006

increased absolute dollar sales while the Razors and Blades segment

sales were flat in absolute dollars and up 2% on a constant currency

basis. See Segment Results below for additional discussion of

sales changes.

Gross Profit Gross profit dollars increased $123.9 in 2007 with

increases in all three segments. The 2007 increase includes favorable

currency of $58.0. In 2006, gross profit dollars increased $3.1 prima-

rily on increases in the Razors and Blades and North America Battery

segments, partially offset by a decline in the International Battery

segment.

Gross margin percentage was 47.7% of sales in 2007, 48.1% in

2006 and 49.4% in 2005. The margin percentage decline in 2007 is

primarily due to lower margin in our International Battery segment.

The margin percentage decline in 2006 reflects lower profit percent-

age in both battery segments, partially offset by an increase in the

Razors and Blades segment. Higher material costs were the primary

factor in battery gross margin percentage declines in both years.

See Segment Results for a discussion of gross profit in each

operating segment.

Selling, General and Administrative Selling, general and administra-

tive expense (SG&A) increased $26.0 in 2007 due to currency

impacts of $15.0 and higher spending in the battery businesses, par-

tially offset by lower restructuring charges. In 2006, SG&A increased

$20.5 due to higher restructuring charges, and to a lesser extent,

increases in each segment.

SG&A expenses were 18.7%, 19.6% and 19.4% of sales in 2007,

2006 and 2005, respectively. The decline in 2007 was driven by the

lower restructuring charges and lower spending as a percent of sales

in the razors and blades business.

Advertising and Promotion Advertising and promotion (A&P)

increased $26.3 in 2007 with increased spending in both battery seg-

ments and currency impacts of $9.6. A&P decreased $18.7 in 2006 on

lower spending in the International Battery and Razors and Blades

segments.

A&P expense was 11.7%, 12.0% and 13.0% of sales for 2007, 2006

and 2005, respectively. A&P expense can vary from year to year with

new product launches, strategic brand support initiatives and the

overall competitive environment.

Research and Development Research and development (R&D)

expense was $70.7 in 2007, $74.2 in 2006 and $69.9 in 2005. The

expense in 2006 includes a $4.6 increase in the Razors and Blades

segment primarily related to a discrete R&D project. As a percent of

sales, R&D expense was 2.1% in 2007, 2.4% in 2006 and 2.3% in 2005.

Segment Results

Operations for the Company are managed via three major segments

– North America Battery (U.S. and Canada battery and lighting