Dollar Tree 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

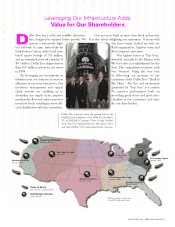

The fourth priority for 2008 was the continued development of our people. This goal

of course is of the utmost importance, as retail is ultimately a “people business.” Therefore,

in 2008, we were committed to driving successful talent management throughout our

organization; to improving succession planning, training, and development; and to further

reduce field management turnover. Overall, we continue to build on the positive, high-per-

formance culture at Dollar Tree, because in order to succeed Dollar Tree must be an excit-

ing, motivating, enthusiastic, and fun place to work.

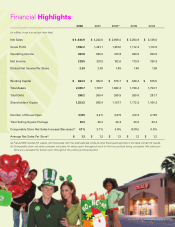

Finally, our fifth goal for 2008 was capital deployment – building value for our

shareholders. This means running the business as effectively as possible, and managing

our capital in a way that enhances shareholder return. For 2008, earnings per diluted share

were $2.53, versus $2.09 in 2007 – a 21% increase. Our share price increased more than

50% for the fiscal year.

Capital expenditures in 2008 were $131 million, compared with $189 million last

year. The majority of capital expenditures this year were for new stores – our best use

of capital – remodeled and relocated stores, and the addition of frozen and refrigerated

capabilities to 135 stores.

Early in the year, we restructured our debt, locking in a $250 million term loan until

2013, and adding the flexibility of a $300 million revolving credit line, if needed. We did

not use the revolving credit line in 2008.

Dollar Tree has long believed that share repurchase can be an effective means of using

excess free cash flow for the benefit of long-term shareholders. In the three years prior to

2008, we invested more than $900 million for repurchase of Dollar Tree stock, including

$473 million in 2007 alone. In 2008, in the face of economic uncertainty, we believed that

the soundest strategy was to build cash, and so we did not repurchase any shares. As a

result, we entered 2009 with more than $364 million in cash and $454 million remaining

in our share repurchase authorization. As has been our practice, we will continue to review

share repurchase opportunistically as a potential tool for building value for our long-term

shareholders.

Corporate Governance and Shareholder Value

I am proud of Dollar Tree’s long-standing commitment to responsible corporate

governance, and of our success in building value for our long-term shareholders.

The Company’s Board of Directors is active, involved and committed to strong cor-

porate governance. The majority of our Board is comprised of independent directors,

all of the standing committees of the Board consist entirely of independent directors and

we have a lead independent director. The Board regularly reviews the Company’s

governance and the effectiveness of the Board, Board committees and individual directors.

The Board is committed to reviewing best practices and is open to making changes. In

recent years these have included the following.

• In 2003:

• Separating the roles of Chairman and CEO.

• In 2007:

• Adopting a majority vote policy for directors who run unopposed,

• Appointing a lead independent director, and

• Adopting detailed Corporate Governance Guidelines.

4

DOLLAR TREE, INC. • 2008 ANNUAL REPORT