Dollar Tree 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

39

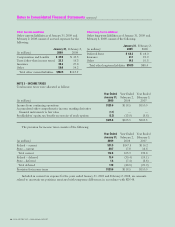

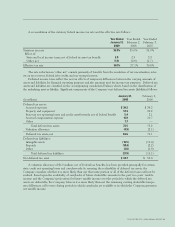

Minimum and Contingent Rentals

Rental expense for store and distribution center operating leases (including payments to related parties) included

in the accompanying consolidated statements of operations are as follows:

Year Ended Year Ended Year Ended

January 31, February 2, February 3,

(in millions) 2009 2008 2007

Minimum rentals $323.9 $295.4 $261.8

Contingent rentals (0.3) 1.2 0.9

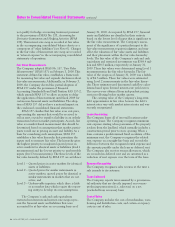

Non-Operating Facilities

The Company is responsible for payments under leas-

es for certain closed stores. The Company accounts for

abandoned lease facilities in accordance with SFAS

No. 146, Accounting for Costs Associated with Exit or

Disposal Activities. A facility is considered abandoned

on the date that the Company ceases to use it. On this

date, the Company records an expense for the present

value of the total remaining costs for the abandoned

facility reduced by any actual or probable sublease

income. Due to the uncertainty regarding the ultimate

recovery of the future lease and related payments,

the Company recorded charges of $0.6 million, $0.1

million and $0.1 million in 2008, 2007 and 2006,

respectively.

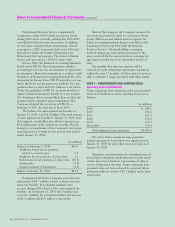

Related Parties

The Company also leases properties for six of its

stores from partnerships owned by related parties. The

total rental payments related to these leases were $0.5

million for each of the years ended January 31, 2009,

February 2, 2008 and February 3, 2007, respectively.

Total future commitments under related party leases

are $0.5 million.

Freight Services

The Company has contracted outbound freight servic-

es from various contract carriers with contracts expir-

ing through February 2013. The total amount of these

commitments is approximately $109.6 million, of

which approximately $86.6 million is committed in

2009, $15.6 million is committed in 2010, $4.4 million

is committed in 2011 and $3.0 million is committed

in 2012.

Technology Assets

The Company has commitments totaling approximately

$3.2 million to purchase store technology assets for its

stores during 2009.

Letters of Credit

In March 2001, the Company entered into a Letter of

Credit Reimbursement and Security Agreement. The

agreement provides $121.5 million for letters of cred-

it. In December 2004, the Company entered into an

additional Letter of Credit Reimbursement and

Security Agreement, which provides $50.0 million for

letters of credit. Letters of credit under both of these

agreements are generally issued for the routine pur-

chase of imported merchandise and approximately

$97.8 million was committed to these letters of credit

at January 31, 2009. As discussed in Note 5, the

Company has $150.0 million of available letters of

credit included in the $550.0 million Unsecured

Credit Agreement (the Agreement) entered into on

February 20, 2008. As of January 31, 2009, there were

no letters of credit committed under the Agreement.

The Company also has approximately $22.5 mil-

lion in stand-by letters of credit that serve as collateral

for its self-insurance programs and expire in fiscal

2009.

Surety Bonds

The Company has issued various surety bonds that

primarily serve as collateral for utility payments at the

Company’s stores. The total amount of the commit-

ment is approximately $4.0 million, which is commit-

ted through various dates through fiscal 2009.

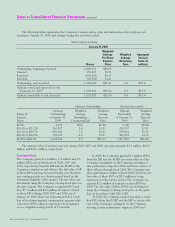

Contingencies

In August of 2006, the Company was served with a

lawsuit filed in federal court in the state of Alabama

by a former store manager. As a collective action, she

claims that she and all other store managers similarly

situated should have been classified as non-exempt

employees under the Fair Labor Standards Act and,

therefore, should have received overtime compensa-

tion and other benefits. The Court preliminarily

allowed nationwide (except for the state of California)

notice to be sent to all store managers employed by

the Company for the three years immediately preced-

ing the filing of the suit. Approximately 770 individu-

als opted in. A second suit was filed in the same

Court, in which the allegations are essentially the

same as those in the first suit. The Court has consoli-

dated the two cases. The Court should decide whether