Dollar Tree 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

Notes to Consolidated Financial Statements continued

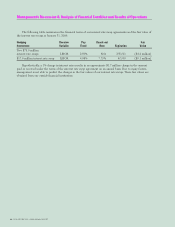

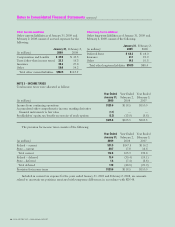

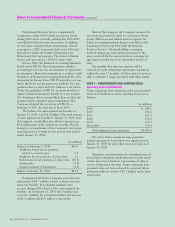

Other Long-Term Liabilities

Other long-term liabilities as of January 31, 2009 and

February 2, 2008 consist of the following:

January 31, February 2,

(in millions) 2009 2008

Deferred Rent $62.3 $ 48.0

Insurance 31.1 29.9

Other 14.5 10.5

Total other long-term liabilities

$107.9 $88.4

Other Current Liabilities

Other current liabilities as of January 31, 2009 and

February 2, 2008 consist of accrued expenses for the

following:

January 31, February 2,

(in millions) 2009 2008

Compensation and benefits $49.9 $ 45.5

Taxes (other than income taxes) 22.3 16.3

Insurance 30.3 27.6

Other 50.0 54.2

Total other current liabilities $152.5 $143.6

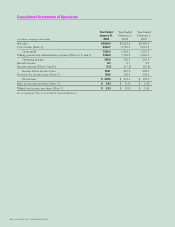

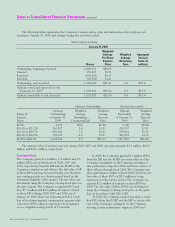

NOTE 3 – INCOME TAXES

Total income taxes were allocated as follows:

Year Ended Year Ended Year Ended

January 31, February 2, February 3,

(in millions) 2009 2008 2007

Income from continuing operations $129.6 $118.5 $110.9

Accumulated other comprehensive income, marking derivative

financial instruments to fair value (1.7) ——

Stockholders’ equity, tax benefit on exercise of stock options (2.3) (13.0) (5.6)

$125.6 $105.5 $105.3

The provision for income taxes consists of the following:

Year Ended Year Ended Year Ended

January 31, February 2, February 3,

(in millions) 2009 2008 2007

Federal – current $91.9 $147.5 $116.2

State – current 20.7 17.8 16.6

Total current 112.6 165.3 132.8

Federal – deferred 15.4 (39.4) (19.1)

State – deferred 1.6 (7.4) (2.8)

Total deferred 17.0 (46.8) (21.9)

Provision for income taxes $129.6 $118.5 $110.9

Included in current tax expense for the years ended January 31, 2009 and February 2, 2008, are amounts

related to uncertain tax positions associated with temporary differences, in accordance with FIN 48.