Dollar Tree 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

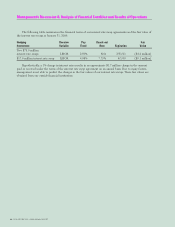

Management’s Discussion & Analysis of Financial Condition and Results of Operations

tain specified financial ratios, restricts the payment of

certain distributions and prohibits the incurrence of

certain new indebtedness. Our March 2004, $450.0

million unsecured revolving credit facility was termi-

nated concurrent with entering into the Agreement.

As of January 31, 2009, the $250.0 million term loan

is outstanding under the Agreement.

In March 2005, our Board of Directors authorized

the repurchase of up to $300.0 million of our com-

mon stock through March 2008. In November 2006,

our Board of Directors authorized the repurchase of

up to $500.0 million of our common stock. This

amount was in addition to the $27.0 million remain-

ing on the March 2005 authorization. Then, in

October 2007, our Board of Directors authorized the

repurchase of an additional $500.0 million of our

common stock. This authorization was in addition to

the November 2006 authorization which had approxi-

mately $98.4 million remaining at the time.

We repurchased approximately 12.8 million

shares for approximately $473.0 million in fiscal 2007

and approximately 8.8 million shares for approximate-

ly $248.2 million in fiscal 2006. We had no share

repurchases in fiscal 2008. At January 31, 2009, we

have approximately $453.7 million remaining under

Board authorization.

Funding Requirements

Overview

We expect our cash needs for opening new stores and

expanding existing stores in fiscal 2009 to total

approximately $138.1 million, which includes capital

expenditures, initial inventory and pre-opening costs.

Our estimated capital expenditures for fiscal 2009 are

between $135.0 and $145.0 million, including

planned expenditures for our new and expanded

stores and the addition of freezers and coolers to

approximately 175 stores. We believe that we can

adequately fund our working capital requirements and

planned capital expenditures for the next few years

from net cash provided by operations and potential

borrowings under our existing credit facility.