Dollar Tree 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

19

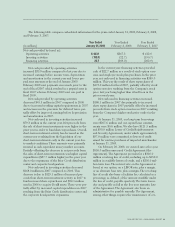

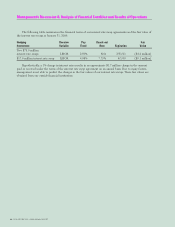

The following table compares cash-related information for the years ended January 31, 2009, February 2, 2008,

and February 3, 2007:

Year Ended Year Ended Year Ended

(in millions) January 31, 2009 February 2, 2008 February 3, 2007

Net cash provided by (used in):

Operating activities $ 403.1 $367.3 $ 412.8

Investing activities (102.0) (22.7) (190.7)

Financing activities 22.7 (389.0) (202.9)

Net cash provided by operating activities

increased $35.8 million compared to last year due to

increased earnings before income taxes, depreciation

and amortization in the current year and lower pre-

paid rent amounts at the end of January 2009.

February 2008 rent payments were made prior to the

end of fiscal 2007 which resulted in a prepaid asset in

fiscal 2007 whereas February 2009 rent was paid in

fiscal 2009.

Net cash provided by operating activities

decreased $45.5 million in 2007 compared to 2006

due to increased working capital requirements in 2007

and increases in the provision for deferred taxes, par-

tially offset by improved earnings before depreciation

and amortization in 2007.

Net cash used in investing activities increased

$79.3 million in the current year. Net proceeds from

the sale of short-term investments were higher in the

prior year in order to fund share repurchases. Overall,

short-term investment activity has decreased in the

current year resulting from the liquidation of our

short-term investments early in the current year due

to market conditions. These amounts were primarily

invested in cash equivalent money market accounts.

Partially offsetting the decrease in net proceeds from

the sales of short-term investments was higher capital

expenditures ($57.7 million higher) in the prior year

due to the expansions of the Briar Creek distribution

center and corporate headquarters.

Net cash used in investing activities decreased

$168.0 million in 2007 compared to 2006. This

decrease is due to $129.1 million of increased pro-

ceeds from short-term investment activity in 2007 to

fund increased share repurchases and $54.1 million

used in 2006 to acquire Deal$ assets. These were par-

tially offset by increased capital expenditures in 2007

resulting from the Briar Creek distribution center and

the corporate headquarters expansions.

In the current year, financing activities provided

cash of $22.7 million as a result of stock option exer-

cises and employee stock plan purchases. In the prior

year, net cash used in financing activities was $389.0

million. This was the result of share repurchases of

$473.0 million for fiscal 2007, partially offset by stock

option exercises resulting from the Company’s stock

price last year being higher than it had been in the

prior several years.

Net cash used in financing activities increased

$186.1 million in 2007 due primarily to increased

share repurchases in 2007 partially offset by increased

proceeds from stock option exercises in 2007 resulting

from the Company’s higher stock price earlier in the

year.

At January 31, 2009, our long-term borrowings

were $267.6 million and our capital lease commit-

ments were $0.6 million. We also have $121.5 million

and $50.0 million Letter of Credit Reimbursement

and Security Agreements, under which approximately

$97.8 million were committed to letters of credit

issued for routine purchases of imported merchandise

at January 31, 2009.

On February 20, 2008, we entered into a five-year

$550.0 million unsecured Credit Agreement (the

Agreement). The Agreement provides for a $300.0

million revolving line of credit, including up to $150.0

million in available letters of credit, and a $250.0 mil-

lion term loan. The interest rate on the Agreement is

based, at our option, on a LIBOR rate, plus a margin,

or an alternate base rate, plus a margin. The revolving

line of credit also bears a facilities fee, calculated as a

percentage, as defined, of the amount available under

the line of credit, payable quarterly. The term loan is

due and payable in full at the five year maturity date

of the Agreement. The Agreement also bears an

administrative fee payable annually. The Agreement,

among other things, requires the maintenance of cer-