Dollar Tree 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

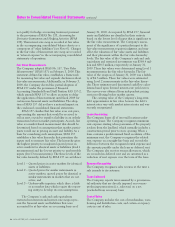

Notes to Consolidated Financial Statements continued

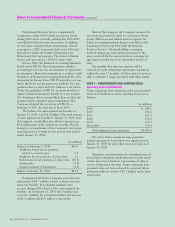

The Internal Revenue Service completed its

examination of the 2004 federal income tax return

during 2008 and is currently auditing the 2005-2007

consolidated federal income tax returns. In addition,

several states completed their examination of fiscal

years prior to 2005. In general, fiscal years 2005 and

forward are within the statute of limitations for

Federal and state tax purposes. The statute of limita-

tions is still open prior to 2005 for some states.

In June 2006, the Financial Accounting Standards

Board issued FIN 48. This Interpretation clarifies

accounting for income tax uncertainties recognized in

an enterprise’s financial statements in accordance with

Statement of Financial Accounting Standards No. 109,

Accounting for Income Taxes. FIN 48 prescribes a recog-

nition threshold and measurement attribute for a tax

position taken or expected to be taken in a tax return.

Under the guidelines of FIN 48, an entity should rec-

ognize a financial statement benefit for a tax position

if it determines that it is more likely than not that the

position will be sustained upon examination. The

Company adopted the provisions of FIN 48 on

February 4, 2007, the first day of fiscal 2007.

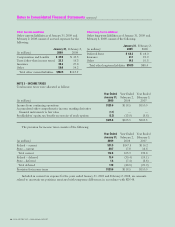

The balance for unrecognized tax benefits at

January 31, 2009, was $14.8 million. The total amount

of unrecognized tax benefits at January 31, 2009, that,

if recognized, would affect the effective tax rate was

$9.8 million (net of the federal tax benefit). The fol-

lowing is a reconciliation of the Company’s total gross

unrecognized tax benefits for the year-to-date period

ended January 31, 2009:

(in millions)

Balance at February 2, 2008 $55.0

Additions, based on tax positions

related to current year 0.8

Additions for tax positions of prior years 1.6

Reductions for tax positions of prior years (36.5)

Settlements (3.8)

Lapses in statute of limitations (2.3)

Balance at January 31, 2009 $14.8

During fiscal 2008, the Company accrued poten-

tial interest of $0.7 million, related to these unrecog-

nized tax benefits. No potential penalties were

accrued during 2008 related to the unrecognized tax

benefits. As of January 31, 2009, the Company has

recorded a liability for potential penalties and interest

of $0.1 million and $3.0 million, respectively.

Most of the change in the Company’s reserve for

uncertain tax positions relates to a reduction of tem-

porary differences and related interest expense for

which accounting method changes were filed at the

beginning of fiscal year 2008 with the Internal

Revenue Service. Voluntarily filing accounting

method changes provides audit protection for the

issues involved for the open periods in exchange for

agreeing to pay the tax over a prescribed period of

time.

It is possible that state tax reserves will be

reduced for audit settlements and statute expirations

within the next 12 months. At this point it is not pos-

sible to estimate a range associated with these audits.

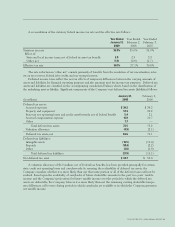

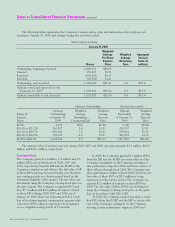

NOTE 4 – COMMITMENTS AND CONTINGENCIES

Operating Lease Commitments

Future minimum lease payments under noncancelable

stores and distribution center operating leases are as

follows:

(in millions)

2009 $ 348.1

2010 304.6

2011 251.4

2012 194.8

2013 130.1

Thereafter 210.4

Total minimum lease payments $1,439.4

The above future minimum lease payments

include amounts for leases that were signed prior to

January 31, 2009 for stores that were not open as of

January 31, 2009.

Minimum rental payments for operating leases do

not include contingent rentals that may be paid under

certain store leases based on a percentage of sales in

excess of stipulated amounts. Future minimum lease

payments have not been reduced by expected future

minimum sublease rentals of $1.7 million under oper-

ating leases.