Dollar Tree 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

15

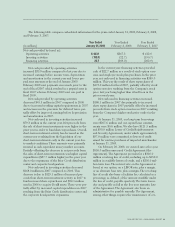

Fiscal 2006 ended on February 3, 2007 and

included 53 weeks, commensurate with the retail cal-

endar. The 53rd week in 2006 added approximately

$70 million in sales. Fiscal 2008 and 2007 ended on

January 31, 2009 and February 2, 2008, respectively,

and both years included 52 weeks.

In fiscal 2008, comparable store net sales

increased by 4.1%. The comparable store net sales

increase was the result of increases of 3.7% in the

number of transactions and a 0.4% increase in average

transaction size. We believe comparable store net sales

continue to be positively affected by a number of our

initiatives, including expansion of forms of payment

accepted by our stores and the roll-out of freezers and

coolers to more of our stores. At January 31, 2009 we

had frozen and refrigerated merchandise in approxi-

mately 1,200 stores compared to approximately 1,100

stores at February 2, 2008. We believe that this

enables us to increase sales and earnings by increasing

the number of shopping trips made by our customers

and increasing the average transaction size. In addition,

we now accept food stamps in approximately 2,200

qualified stores compared to 1,000 at the end of 2007.

Beginning October 31, 2007, all of our stores accept

Visa credit which has had a positive impact on our

sales for fiscal 2008.

With the pressures of the current economic envi-

ronment, we have seen an increase in the demand for

basic, consumable merchandise in 2008. As a result,

we have shifted the mix of inventory carried in our

stores to more consumer product merchandise which

we believe increases the traffic in our stores and has

helped to increase our sales even during the current

economic downturn. This shift has negatively impact-

ed our margins in 2008, and we believe that this

increase in basic, consumer product merchandise will

negatively impact our margins in the first half of 2009.

Our point-of-sale technology provides us with

valuable sales and inventory information to assist our

buyers and improve our merchandise allocation to our

stores. We believe that this has enabled us to better

manage our inventory flow resulting in more efficient

distribution and store operations and increased inven-

tory turnover for each of the last two years. Inventory

turnover improved by approximately 5 basis points in

2008 compared to 2007 and by approximately 25

basis points in 2007 compared to 2006. Fiscal 2008

was the fourth consecutive year of increased inventory

• In October 2007, our Board of Directors author-

ized the repurchase of an additional $500.0 mil-

lion of our common stock. This authorization was

in addition to the November 2006 authorization

which had approximately $98.4 million remaining.

At January 31, 2009, we had approximately $453.7

million remaining under Board authorizations.

Overview

Our net sales are derived from the sale of merchan-

dise. Two major factors tend to affect our net sales

trends. First is our success at opening new stores or

adding new stores through acquisitions. Second, sales

vary at our existing stores from one year to the next.

We refer to this change as a change in comparable

store net sales, because we compare only those stores

that are open throughout both of the periods being

compared. We include sales from stores expanded dur-

ing the year in the calculation of comparable store net

sales, which has the effect of increasing our compara-

ble store net sales. The term 'expanded' also includes

stores that are relocated.

At January 31, 2009, we operated 3,591 stores in

48 states, with 30.3 million selling square feet com-

pared to 3,411 stores with 28.4 million selling square

feet at February 2, 2008. During fiscal 2008, we

opened 231 stores, expanded 86 stores and closed 51

stores, compared to 240 new stores opened, 102 stores

expanded and 48 stores closed during fiscal 2007. In

the current year we increased our selling square

footage by 6.7%. Of the 1.9 million selling square foot

increase in 2008, 0.3 million was added by expanding

existing stores. The average size of our stores opened

in 2008 was approximately 8,100 selling square feet

(or about 10,300 gross square feet). The average new

store size decreased slightly in 2008 from approxi-

mately 8,500 selling square feet (or about 10,800

gross square feet) for new stores in 2007. For 2009,

we continue to plan to open stores that are approxi-

mately 8,000–10,000 selling square feet (or about

10,000–12,000 gross square feet). We believe that this

store size is our optimal size operationally and that

this size also gives our customers an ideal shopping

environment that invites them to shop longer and buy

more. We expect the majority of our future net sales

growth to come from the square footage growth

resulting from new store openings and expansion of

existing stores.