Dollar Tree 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

Management’s Discussion & Analysis of Financial Condition and Results of Operations

• why those net sales, earnings, gross margins and

costs were different from the year before;

• how all of this affects our overall financial

condition;

• what our expenditures for capital projects were in

2008 and 2007 and what we expect them to be

in 2009; and

• where funds will come from to pay for future

expenditures.

As you read Management’s Discussion and

Analysis, please refer to our consolidated financial

statements, included in this Annual Report, which

present the results of operations for the fiscal years

ended January 31, 2009, February 2, 2008 and

February 3, 2007. In Management’s Discussion and

Analysis, we analyze and explain the annual changes in

some specific line items in the consolidated financial

statements for the fiscal year 2008 compared to the

comparable fiscal year 2007 and the fiscal year 2007

compared to the comparable fiscal year 2006.

Key Events and Recent Developments

Several key events have had or are expected to have a

significant effect on our operations. You should keep

in mind that:

• On February 20, 2008, we entered into a five-year

$550.0 million unsecured Credit Agreement

(the Agreement). The Agreement provides for a

$300.0 million revolving line of credit, including

up to $150.0 million in available letters of credit,

and a $250.0 million term loan. The interest rate

on the facility is based, at our option, on a LIBOR

rate, plus a margin, or an alternate base rate, plus

a margin. Our March 2004, $450.0

million unsecured revolving credit facility was

terminated concurrent with entering into the

Agreement.

• On March 2, 2008, we reorganized by creating a

new holding company structure. The new parent

company is Dollar Tree, Inc., replacing Dollar Tree

Stores, Inc., which is now an operating subsidiary.

• On March 20, 2008, we entered into two $75.0

million interest rate swap agreements. These inter-

est rate swaps are used to manage the risk associ-

ated with interest rate fluctuations on a portion of

our $250.0 million variable rate term loan.

the date of this annual report and you should not

expect us to do so.

Investors should also be aware that while we do,

from time to time, communicate with securities ana-

lysts and others, we do not, by policy, selectively dis-

close to them any material, nonpublic information or

other confidential commercial information. Accordingly,

shareholders should not assume that we agree with

any statement or report issued by any securities analyst

regardless of the content of the statement or report.

We do not issue detailed financial forecasts or projec-

tions and we do not, by policy, confirm those issued

by others. Thus, to the extent that reports issued by

securities analysts contain any projections, forecasts or

opinions, such reports are not our responsibility.

INTRODUCTORY NOTE:

Unless otherwise stated,

references to “we,” “our” and “Dollar Tree” generally refer

to Dollar Tree, Inc. and its direct and indirect subsidiaries

on a consolidated basis. Unless specifically indicated oth-

erwise, any references to “2009” or “fiscal 2009”, “2008”

or “fiscal 2008”, “2007” or “fiscal 2007”, and “2006”

or “fiscal 2006,” relate to as of or for the years ended

January 30, 2010, January 31, 2009, February 2, 2008

and February 3, 2007, respectively.

On March 2, 2008, we reorganized by creating a

new holding company structure. The new parent com-

pany is Dollar Tree, Inc., replacing Dollar Tree Stores,

Inc., which is now an operating subsidiary.

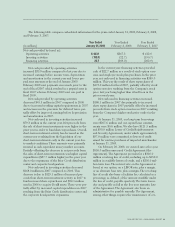

Available Information

Our annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and

amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities

Exchange Act are available free of charge on our

website at www.dollartree.com as soon as reasonably

practicable after electronic filing of such reports with

the SEC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In Management’s Discussion and Analysis, we explain

the general financial condition and the results of oper-

ations for our company, including:

• what factors affect our business;

• what our net sales, earnings, gross margins and

costs were in 2008, 2007 and 2006;