Dollar Tree 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

Notes to Consolidated Financial Statements continued

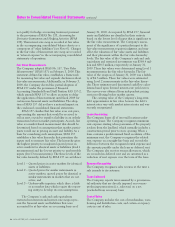

not qualify for hedge accounting treatment pursuant

to the provisions of SFAS No. 133, Accounting for

Derivative Instruments and Hedging Activities (SFAS

133). This interest rate swap is recorded at fair value

in the accompanying consolidated balance sheets as a

component of “other liabilities” (see Note 6). Changes

in the fair value of this interest rate swap are recorded

as "interest expense” in the accompanying consolidated

statements of operations.

Fair Value Measurements

The Company adopted SFAS No. 157, “Fair Value

Measurements” (SFAS 157) on February 3, 2008. This

statement defines fair value, establishes a framework

for measuring fair value and expands disclosures about

fair value measurements. Additionally, on February 3,

2008, the Company elected the partial adoption of

SFAS 157 under the provisions of Financial

Accounting Standards Board Staff Position FAS 157-2,

which amends SFAS 157 to allow an entity to delay

the application of this statement until fiscal 2009 for

certain non-financial assets and liabilities. The adop-

tion of SFAS 157 did not have a material impact on

the condensed consolidated financial statements.

SFAS 157 clarifies that fair value is an exit price,

representing the amount that would be received to

sell an asset or paid to transfer a liability in an orderly

transaction between market participants. As such, fair

value is a market-based measurement that should be

determined based on assumptions that market partici-

pants would use in pricing an asset and liability. As a

basis for considering such assumptions, SFAS 157

establishes a fair value hierarchy that prioritizes the

inputs used to measure fair value. The hierarchy gives

the highest priority to unadjusted quoted prices in

active markets for identical assets or liabilities (level 1

measurement) and the lowest priority to unobservable

inputs (level 3 measurements). The three levels of the

fair value hierarchy defined by SFAS 157 are as follows:

Level 1 – Quoted prices in active markets for identical

assets or liabilities;

Level 2 – Quoted prices for similar instruments in

active markets; quoted prices for identical or

similar instruments in markets that are not

active; and

Level 3 – Unobservable inputs in which there is little

or no market data which require the report-

ing entity to develop its own assumptions.

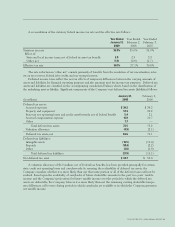

The Company’s cash and cash equivalents,

restricted investments and interest rate swaps repre-

sent the financial assets and liabilities that were

accounted for at fair value on a recurring basis as of

January 31, 2009. As required by SFAS 157, financial

assets and liabilities are classified in their entirety

based on the lowest level of input that is significant to

the fair value measurement. The Company's assess-

ment of the significance of a particular input to the

fair value measurement requires judgment, and may

affect the valuation of fair value assets and liabilities

and their placement within the fair value hierarchy

levels. The fair value of the Company’s cash and cash

equivalents and restricted investments was $364.4 mil-

lion and $58.5 million, respectively at January 31,

2009. These fair values were determined using Level 1

measurements in the fair value hierarchy. The fair

value of the swaps as of January 31, 2009 was a liabili-

ty of $4.5 million. These fair values were estimated

using Level 2 measurements in the fair value hierar-

chy. These estimates used discounted cash flow calcu-

lations based upon forward interest-rate yield curves.

The curves were obtained from independent pricing

services reflecting broker market quotes.

The carrying value of the Company's long-term

debt approximates its fair value because the debt’s

interest rates vary with market interest rates and was

recently renegotiated.

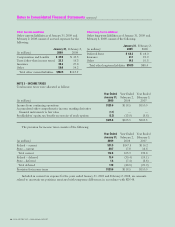

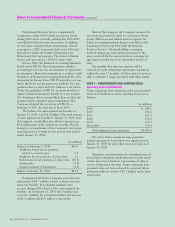

Lease Accounting

The Company leases all of its retail locations under

operating leases. The Company recognizes minimum

rent expense starting when possession of the property

is taken from the landlord, which normally includes a

construction period prior to store opening. When a

lease contains a predetermined fixed escalation of the

minimum rent, the Company recognizes the related

rent expense on a straight-line basis and records the

difference between the recognized rental expense and

the amounts payable under the lease as deferred rent.

The Company also receives tenant allowances, which

are recorded in deferred rent and are amortized as a

reduction of rent expense over the term of the lease.

Revenue Recognition

The Company recognizes sales revenue at the time a

sale is made to its customer.

Taxes Collected

The Company reports taxes assessed by a governmen-

tal authority that are directly imposed on revenue-

producing transactions (i.e., sales tax) on a net

(excluded from revenues) basis.

Cost of Sales

The Company includes the cost of merchandise, ware-

housing and distribution costs, and certain occupancy

costs in cost of sales.