Dollar General 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

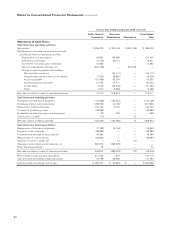

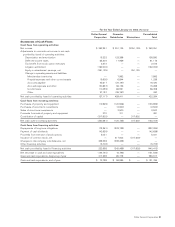

Notes to Consolidated Financial Statements (continued)

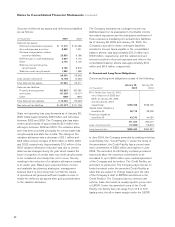

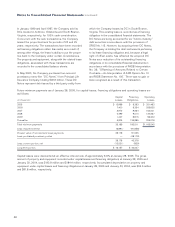

On November 30, 2004, the Board of Directors authorized

the Company to repurchase up to 10 million shares of its

outstanding common stock. Purchases may be made in

the open market or in privately negotiated transactions

from time to time subject to market conditions. The

objective of the share repurchase program was to

enhance shareholder value by purchasing shares at

a price that produces a return on investment that is

greater than the Company’s cost of capital. Additionally,

share repurchases generally will be undertaken only if

such purchases result in an accretive impact on the

Company’s fully diluted earnings per share calculation.

This authorization expires November 30, 2005. During

2004, the Company purchased approximately 0.5 million

shares pursuant to this authorization at a total cost of

$10.9 million.

On March 13, 2003, the Board of Directors authorized

the Company to repurchase up to 12 million shares of

its outstanding common stock in the open market or

in privately negotiated transactions from time to time

subject to market conditions. The objective of the share

repurchase program is consistent with the November

2004 repurchase program as described above. This

authorization expired March 13, 2005. During 2003,

approximately 1.5 million shares were repurchased at a

total cost of $29.7 million. During 2004, the Company

purchased approximately 10.5 million shares at a

total cost of $198.4 million. As of January 28, 2005,

approximately 12.0 million shares had been purchased,

substantially completing this share repurchase

authorization.

12. Related Party Transactions

In 2002, Cal Turner, the Company’s then Chairman and

Chief Executive Officer, made voluntary payments to the

Company totaling approximately $6.8 million in cash. Of

such amount, approximately $6.0 million represented the

value on April 10, 2002 of stock Mr. Turner acquired on

April 7, 1999 and April 20, 2000 upon the exercise of

stock options (net of the strike price of such options)

and approximately $0.8 million represented the value of

performance-based bonuses received by Mr. Turner in

April 1999 and April 2000. Mr. Turner voluntarily paid

such amounts to the Company because the options

vested and the performance bonuses were paid based

on performance measures that were attained under

the Company’s originally reported financial results for

the period covered by the 2001 Restatement. Those

measures would not have been attained under the

subsequently restated results. The Company recorded

the approximately $6.0 million receipt as a contribution of

capital, which was recorded as an increase in Additional

paid-in capital included in shareholders’ equity as of

January 31, 2003. The Company recorded the approxi-

mately $0.8 million receipt as a reduction of SG&A

expenses during the third quarter of 2002.

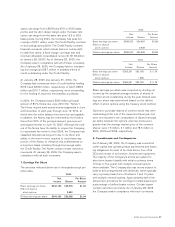

13. Segment Reporting

The Company manages its business on the basis of one

reportable segment. See Note 1 for a brief description of

the Company’s business. As of January 28, 2005, all of

the Company’s operations were located within the United

States with the exception of an immaterial Hong Kong

subsidiary formed to assist in the process of importing

certain merchandise that began operations in early 2004.

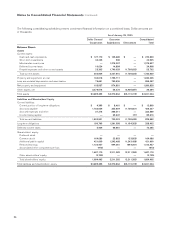

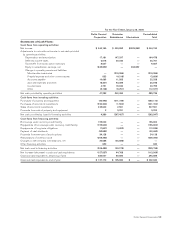

The following data is presented in accordance with SFAS

No. 131, “Disclosures about Segments of an Enterprise

and Related Information.”

(In thousands) 2004 2003 2002

Classes of similar

products:

Net sales:

Highly consumable $4,825,051 $4,206,878 $3,674,929

Seasonal 1,263,991 1,156,114 994,250

Home products 879,476 860,867 808,518

Basic clothing 692,409 648,133 622,707

$7,660,927 $6,871,992 $6,100,404