Dollar General 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 37

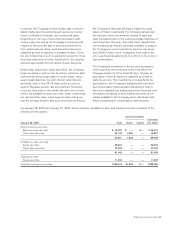

In general, the Company invests excess cash in shorter-

dated, highly liquid investments such as money market

funds, certificates of deposit, and commercial paper.

Depending on the type of securities purchased (debt

versus equity) as well as the Company’s intentions with

respect to the potential sale of such securities before

their stated maturity dates, such securities have been

classified as held-to-maturity or available-for-sale. Given

the short maturities of such investments (except for those

securities described in further detail below), the carrying

amounts approximate the fair values of such securities.

Additionally, beginning in fiscal year 2003, the Company

began investing in auction rate securities, which are debt

instruments having longer-dated (in some cases, many

years) legal maturities, but with interest rates that are

generally reset every 28-35 days under an auction

system. Because auction rate securities are frequently

re-priced, they trade in the market like short-term invest-

ments. As available-for-sale securities, these investments

are carried at fair value, which approximates cost given

that the average duration that such securities are held by

the Company is less than 40 days. Despite the liquid

nature of these investments, the Company categorizes

them as short-term investments instead of cash and

cash equivalents due to the underlying legal maturities of

such securities. However, they have been classified as

current assets as they are generally available to support

the Company’s current operations. Auction rate securi-

ties of $67.2 million were reclassified from cash in the

prior year financial statements to conform to the current

year presentation.

The Company’s investment in the secured promissory

notes issued by the third-party entity from which the

Company leases its DC in South Boston, Virginia, as

discussed in Note 8, has been classified as a held-to-

maturity security. The investments in mutual funds by

participants in the Company’s supplemental retirement

and compensation deferral plans discussed in Note 9

have been classified as trading securities. Historical cost

information pertaining to such trading securities is not

readily available to the Company since individuals hold

these investments in compensation deferral plans.

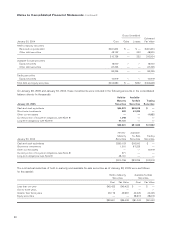

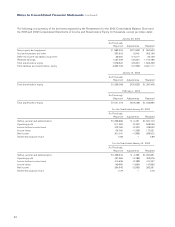

On January 28, 2005 and January 30, 2004, held-to-maturity, available-for-sale, and trading securities consisted of the

following (in thousands):

Gross Unrealized

January 28, 2005 Cost

Estimated

Fair ValueGains Losses

Held-to-maturity securities

Bank and corporate debt $ 45,422 $ — $ — $ 45,422

Other debt securities 48,179 1,808 — 49,987

93,601 1,808 — 95,409

Available-for-sale securities

Equity securities 38,618 — — 38,618

Other debt securities 42,425 — — 42,425

81,043 — — 81,043

Trading securities

Equity securities 11,932 — — 11,932

Total debt and equity securities $186,576 $1,808 $ — $188,384