Dollar General 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 43

Accounting pronouncements

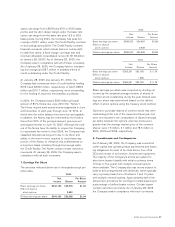

In December 2004, the FASB issued SFAS No. 123R,

“Share-Based Payment,” which will require all companies

to measure compensation cost for all share-based pay-

ments (including employee stock options) at fair value.

This new standard will be effective for public companies

for interim or annual periods beginning after June 15,

2005. Companies can adopt the new standard in one of

two ways: (i) the modified prospective application, in

which a company would recognize share-based employee

compensation cost from the beginning of the fiscal period

in which the recognition provisions are first applied as if

the fair-value-based accounting method had been used

to account for all employee awards granted, modified or

settled after the effective date and to any awards that

were not fully vested as of the effective date; or (ii) the

modified retrospective application, in which a company

would recognize employee compensation cost for periods

presented prior to the adoption of SFAS No. 123R in

accordance with the original provisions of SFAS No. 123,

“Accounting for Stock-Based Compensation,” pursuant

to which an entity would recognize employee compensa-

tion cost in the amounts reported in the pro forma disclo-

sures provided in accordance with SFAS No. 123. The

Company expects to adopt SFAS No. 123R during the

third quarter of 2005, using the modified prospective

application, and expects to incur incremental expense

associated with the adoption of approximately $4 million

to $8 million in 2005. See “Stock-based compensation”

above for additional disclosures pertaining to the pro

forma effects of stock option grants as determined using

the methodology prescribed under SFAS No. 123.

Reclassifications

Certain reclassifications of the 2003 and 2002 amounts

have been made to conform to the 2004 presentation,

including the reclassification of certain short-term invest-

ments which were previously classified as cash and cash

equivalents as further described above.

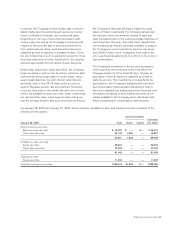

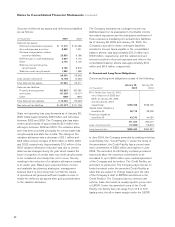

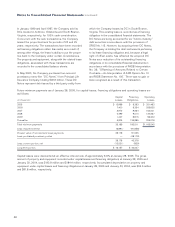

2. Restatement of Financial Statements

Following a review of the Company’s lease accounting

and leasehold amortization practices, the Company

identified areas where its practices differed from the

views expressed by the Securities and Exchange

Commission (“SEC”) in a letter released on February 7,

2005. The Company determined that it would change

its practices, as discussed below, to conform to the

SEC’s views and GAAP. The Company determined that,

because the cumulative adjustments resulting from these

corrections would have been material to the financial

statements for the year ended January 28, 2005, it was

required to restate its financial statements for fiscal

years 2000 through 2003 (the “Restatement”). The

Restatement was technically required even though the

adjustments for each individual year are not material

to that year’s previously reported results (including

previously reported 2004 results) and have no impact

on the Company’s current or future cash flows.

Previously, the Company amortized all leasehold

improvements over eight years, which was estimated

to be the approximate useful life of the asset to the

Company, given the nature of the assets and historical

lease renewal practices. Under the corrected method,

the Company has changed its practice to amortize

leasehold improvements over the shorter of eight years

or the applicable non-cancelable lease term. In addition,

the Company previously recognized straight-line rent

expense for leases beginning on the earlier of the store

opening date or the rent payment commencement date,

which had the effect of excluding the period used for

preparing the store for opening (approximately 30 days)

from the calculation of the period over which rent was

expensed. Under the corrected method, the Company

has changed its practice to include the period of time

needed to prepare the store for opening in its calculation

of straight-line rent.