Dollar General 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 35

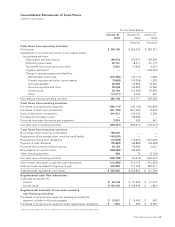

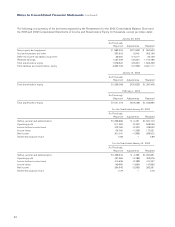

Consolidated Statements of Cash Flows

(Dollarsinthousands)

For the Years Ended

January 28,

2005

January 30,

2004

January 31,

2003

(Restated) (Restated)

Cash flows from operating activities:

Net income $ 344,190 $ 299,002 $ 262,351

Adjustments to reconcile net income to net cash provided

by operating activities:

Depreciation and amortization 164,478 154,457 138,590

Deferred income taxes 25,751 18,611 81,173

Tax benefit from stock option exercises 9,657 14,565 2,372

Litigation settlement —— (162,000)

Change in operating assets and liabilities:

Merchandise inventories (219,396) (34,110) 7,992

Prepaid expenses and other current assets (3,666) (16,304) 1,239

Accounts payable 22,258 33,265 18,420

Accrued expenses and other 35,048 60,523 15,269

Income taxes 23,793 (21,464) 56,458

Other (12,377) 5,166 430

Net cash provided by operating activities 389,736 513,711 422,294

Cash flows from investing activities:

Purchases of property and equipment (292,172) (140,139) (133,895)

Purchases of short-term investments (221,700) (201,950) (2,500)

Sales of short-term investments 247,501 134,725 2,500

Purchase of promissory notes —(49,582) —

Proceeds from sale of property and equipment 3,324 269 481

Net cash used in investing activities (263,047) (256,677) (133,414)

Cash flows from financing activities:

Borrowings under revolving credit facility 195,000 — —

Repayments of borrowings under revolving credit facility (195,000) — —

Repayments of long-term obligations (12,539) (15,907) (397,094)

Payment of cash dividends (52,682) (46,883) (42,638)

Proceeds from exercise of stock options 34,128 49,485 5,021

Repurchases of common stock (209,295) (29,687) —

Other financing activities 630 73 (5,702)

Net cash used in financing activities (239,758) (42,919) (440,413)

Net increase (decrease) in cash and cash equivalents (113,069) 214,115 (151,533)

Cash and cash equivalents, beginning of year 345,899 131,784 283,317

Cash and cash equivalents, end of year $ 232,830 $ 345,899 $ 131,784

Supplemental cash flow information:

Cash paid during year for:

Interest $ 26,748 $ 31,256 $ 41,015

Income taxes $ 133,100 $ 165,248 $ 1,834

Supplemental schedule of non-cash investing

and financing activities:

Purchases of property and equipment awaiting processing for

payment, included in Accounts payable $ 12,921 $ 9,643 $ 420

Purchases of property and equipment under capital lease obligations $ 1,844 $ 996 $ 8,453

The accompanying notes are an integral part of the consolidated financial statements.