Dollar General 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 39

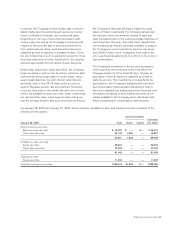

For the years ended January 28, 2005, January 30, 2004

and January 31, 2003, gross realized gains and losses on

the sales of available-for-sale securities were not mate-

rial. The cost of securities sold is based upon the specific

identification method.

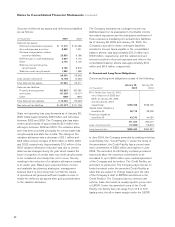

Merchandise inventories

Inventories are stated at the lower of cost or market with

cost determined using the retail last-in, first-out (“LIFO”)

method. The excess of current cost over LIFO cost was

approximately $6.3 million at January 28, 2005 and

$6.5 million at January 30, 2004. Current cost is deter-

mined using the retail first-in, first-out method. LIFO

reserves decreased $0.2 million in 2004, increased $0.7

million in 2003 and decreased $8.9 million in 2002. Costs

directly associated with warehousing and distribution are

capitalized into inventory.

Pre-opening costs

Pre-opening costs for new stores are expensed as

incurred.

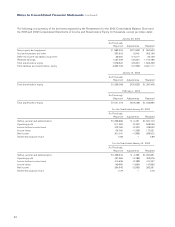

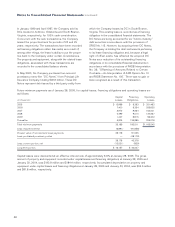

Property and equipment

Property and equipment are recorded at cost. The

Company provides for depreciation and amortization

on a straight-line basis over the following estimated

useful lives:

Land improvements 20

Buildings 39–40

Furniture, fixtures and equipment 3–10

Improvements of leased properties are amortized over

the shorter of the life of the applicable lease term or the

estimated useful life of the asset.

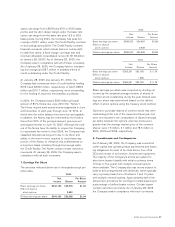

Impairment of long-lived assets

When indicators of impairment are present, the Company

evaluates the carrying value of long-lived assets, other

than goodwill, in relation to the operating performance

and future undiscounted cash flows or the appraised

values of the underlying assets. The Company adjusts

the net book value of the underlying assets based upon

an analysis of the sum of expected future cash flows

compared to the book value, and may also consider

appraised values. Assets to be disposed of are adjusted

to the fair value less the cost to sell if less than the book

value. The Company recorded impairment charges of

approximately $0.5 million and $0.6 million in 2004 and

2003, respectively, and $4.7 million prior to 2002 to

reduce the carrying value of the Homerville, Georgia DC

(which was closed in fiscal 2000 and sold in 2004). The

Company also recorded impairment charges of approxi-

mately $0.2 million in each of 2004 and 2003 to reduce

the carrying value of certain of its stores based upon

negative sales trends and cash flows at these locations.

These charges are included in Selling, general and

administrative (“SG&A”) expense.

Other assets

Other assets consist primarily of debt issuance costs

which are amortized over the life of the related obliga-

tions, utility and security deposits, life insurance policies

and goodwill.

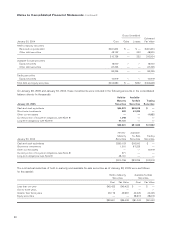

Vendor rebates

The Company records vendor rebates, primarily consisting

of new store allowances and volume purchase rebates,

when realized. The rebates are recorded as a reduction

to inventory purchases, at cost, which has the effect of

reducing cost of goods sold, as prescribed by Emerging

Issues Task Force (“EITF”) Issue No. 02-16, “Accounting by

a Customer (including a Reseller) for Certain Consideration

Received from a Vendor” (“EITF 02-16”).

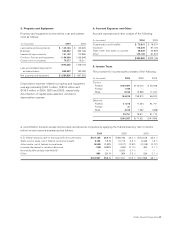

Operating leases

Contingentrentals. The Company recognizes contingent

rental expense when the achievement of specified sales

targets are considered probable, in accordance with EITF

Issue No. 98-9, “Accounting for Contingent Rent.” The

amount expensed but not paid as of January 28, 2005

and January 30, 2004 was approximately $8.6 million

and $8.9 million, respectively, and is included in Accrued

expenses and other in the consolidated balance sheets.

(See Notes 4 and 8).

Deferredrent. The Company records rental expense on

a straight-line basis over the base, non-cancelable lease

term commencing on the date that the Company takes

physical possession of the property. Any difference

between the calculated expense and the amounts actu-

ally paid are reflected as a liability in Accrued expenses

and other in the consolidated balance sheets and

totaled approximately $18.0 million and $14.0 million at

January 28, 2005 and January 30, 2004, respectively.