Dollar General 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

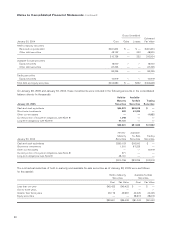

Notes to Consolidated Financial Statements (continued)

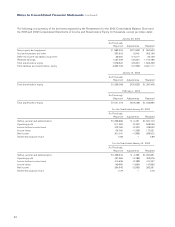

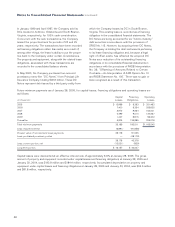

Gross Unrealized

January 30, 2004 Cost

Estimated

Fair ValueGains Losses

Held-to-maturity securities

Bank and corporate debt $261,604 $ — $ — $261,604

Other debt securities 49,132 — 232 48,900

310,736 — 232 310,504

Available-for-sale securities

Equity securities 16,000 — — 16,000

Other debt securities 67,225 — — 67,225

83,225 — — 83,225

Trading securities

Equity securities 10,919 — — 10,919

Total debt and equity securities $404,880 $ — $232 $404,648

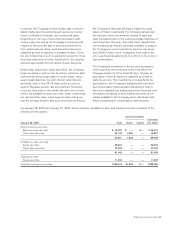

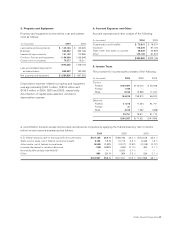

On January 28, 2005 and January 30, 2004, these investments were included in the following accounts in the consolidated

balance sheets (in thousands):

January 28, 2005

Held-to-

Maturity

Securities

Available-

for-Sale

Securities

Trading

Securities

Cash and cash equivalents $44,922 $38,618 $ —

Short-term investments 500 42,425 —

Other current assets — — 11,932

Current portion of long-term obligations (see Note 8) 1,048 — —

Long-term obligations (see Note 8) 47,131 — —

$93,601 $81,043 $11,932

January 30, 2004

Held-to-

Maturity

Securities

Available-

for-Sale

Securities

Trading

Securities

Cash and cash equivalents $260,103 $16,000 $ —

Short-term investments 1,501 67,225 —

Other current assets — — 10,919

Current portion of long-term obligations (see Note 8) 971 — —

Long-term obligations (see Note 8) 48,161 — —

$310,736 $83,225 $10,919

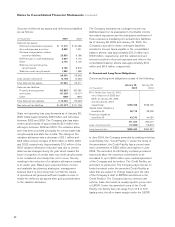

The contractual maturities of held-to-maturity and available-for-sale securities as of January 28, 2005 were as follows

(in thousands):

Held-to-Maturity

Securities

Available-for-Sale

Securities

Cost Fair Value Cost Fair Value

Less than one year $45,422 $45,422 $ — $ —

One to three years — — — —

Greater than three years 48,179 49,987 42,425 42,425

Equity securities — — 38,618 38,618

$93,601 $95,409 $81,043 $81,043