Dollar General 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 51

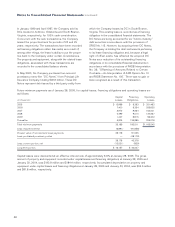

with 10 or more “years of service” or upon termination

of employment due to death or “total and permanent

disability” or upon a “change in control,” all as defined

in the plan. Compensation expense for these plans was

approximately $0.6 million in 2004, $0.5 million in 2003

and $0.2 million in 2002.

Beginning September 2000, the supplemental retirement

plan and compensation deferral plan assets are invested

at the option of the participant in either an account that

mirrors the performance of a fund or funds selected by

the Compensation Committee of the Company’s Board

of Directors or its delegate (the “Mutual Fund Options”)

or in an account which mirrors the performance of the

Company’s common stock (the “Common Stock

Option”). Pursuant to a provision in the November 1,

2004 amendment that was effective January 1, 2005,

investments in the Common Stock Option cannot be

subsequently diversified and investments in the Mutual

Fund Options cannot be subsequently transferred into

the Common Stock Option.

In accordance with a participant’s election, a participant’s

compensation deferral plan and supplemental retirement

plan account balances will be paid in cash by (a) lump

sum, (b) monthly installments over a 5, 10 or 15-year

period or (c) a combination of lump sum and installments.

The vested amount will be payable at the time designated

by the plan upon the participant’s termination of employ-

ment or retirement, except that participants may elect to

receive an in-service lump sum distribution of vested

amounts credited to the compensation deferral account,

provided that the date of distribution is a date that is no

sooner than five years after the end of the year in which

amounts are deferred. In addition, a participant who is an

employee may request to receive an “unforeseeable

emergency hardship” in-service lump sum distribution of

vested amounts credited to his compensation deferral

account. Effective January 1, 2005 for active participants,

account balances deemed to be invested in the Mutual

Fund Options are payable in cash and account balances

deemed to be invested in the Common Stock Option are

payable in shares of Dollar General common stock and

cash in lieu of fractional shares. Prior to January 1, 2005,

all account balances were payable in cash.

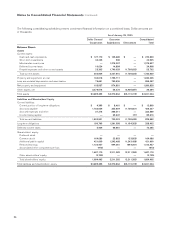

The Mutual Funds Options are stated at fair market value,

which is based on quoted market prices, and are included

in Other current assets. In accordance with EITF 97-14,

“Accounting for Deferred Compensation Arrangements

Where Amounts Earned Are Held in a Rabbi Trust and

Invested,” the Company’s stock is recorded at historical

cost and included in Other shareholders’ equity. The

deferred compensation liability related to the Company

stock for active plan participants was reclassified to

stockholders’ equity and subsequent changes to the fair

value of the obligation will not be recognized, in accor-

dance with the provisions of EITF 97-14. The deferred

compensation liability related to the Mutual Funds

Options is recorded at the fair value of the investments

held in the trust and is included in Accrued expenses and

other in the consolidated balance sheets.

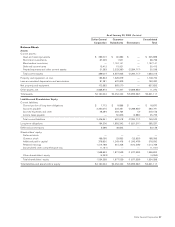

During 2003, the Company established two supplemental

executive retirement plans, each with one executive par-

ticipant. During 2004, one of these plans was terminated

in connection with the termination of that participant’s

employment. The Company accounts for the remaining

plan in accordance with SFAS No. 87, “Employers’

Accounting for Pensions”, as amended by SFAS

No. 132, “Employers’ Disclosures about Pensions and

Other Postretirement Benefits”, and supplemented by

SFAS No. 130, “Reporting Comprehensive Income,”

but has not included additional disclosures due to

their immateriality.

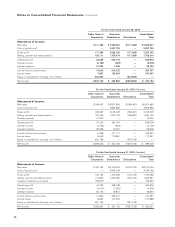

Non-employee directors may defer all or a part of any

fees normally paid by the Company to them pursuant to

a voluntary non-qualified compensation deferral plan.

The compensation eligible for deferral includes the annual

retainer, meeting and other fees, as well as any per diem

compensation for special assignments, earned by a

director for his or her service to the Company’s Board

of Directors or one of its committees. The compensation

deferred is credited to a liability account, which is then

invested at the option of the director in either an account

that mirrors the performance of a fund selected by the

Compensation Committee (the “Mutual Fund Options”),

or in an account which mirrors the performance of

the Company’s common stock (the “Common Stock

Option”). In accordance with a director’s election, the

deferred compensation will be paid in a lump sum or in

monthly installments over a 5, 10 or 15-year period, or a

combination of both, at the time designated by the plan

upon a director’s resignation or termination from the

Board. However, a director may request to receive an

“unforeseeable emergency hardship” in-service lump