Dollar General 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 27

TheCompany’sreputationandfinancialconditioncould

beaffectedbytheSECinvestigation.As previously

disclosed in the Company’s periodic reports filed with

the SEC, the Company restated its audited financial

statements for fiscal years 1999 and 1998, and certain

unaudited financial information for fiscal year 2000, by

means of its Form 10-K for the fiscal year ended

February 2, 2001, which was filed on January 14, 2002

(the “2001 Restatement”).

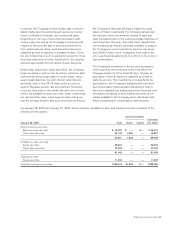

The SEC has been conducting an investigation into the

circumstances giving rise to the 2001 Restatement and,

on January 8, 2004, the Company received notice that

the SEC staff was considering recommending that the

SEC bring a civil injunctive action against the Company

for alleged violations of the federal securities laws in

connection with circumstances relating to the 2001

Restatement. The Company subsequently reached an

agreement in principle with the SEC staff to settle the

matter. Under the terms of the agreement in principle,

the Company will consent, without admitting or denying

the allegations in a complaint to be filed by the SEC,

to the entry of a permanent civil injunction against future

violations of the antifraud, books and records, reporting

and internal control provisions of the federal securities

laws and related SEC rules and will pay a $10 million

non-deductible civil penalty. The agreement with the

SEC staff is subject to final approval by the court in

which the SEC’s complaint is filed. The Company

accrued $10 million with respect to the penalty in its

financial statements for the year ended January 30,

2004, and this accrual remains outstanding as of January

28, 2005. The Company can give no assurances that the

court will approve this agreement. If the agreement is not

approved, the Company could be subject to different or

additional penalties, both monetary and non-monetary,

which could adversely affect the Company’s financial

statements as a whole. The publicity surrounding the

SEC investigation and settlement also could affect the

Company’s reputation and have an adverse impact on

its financial statements as a whole.

Readers are cautioned not to place undue reliance on

forward-looking statements made herein, since the

statements speak only as of the date of this report.

Except as may be required by law, the Company

undertakes no obligation to publicly update or revise

any forward-looking statements contained herein to

reflect events or circumstances occurring after the

date of this report or to reflect the occurrence of unan-

ticipated events. Readers are advised, however, to

consult any further disclosures the Company may

make on related subjects in its documents filed with or

furnished to the SEC or in its other public disclosures.