Dollar General 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 19

As described in Note 8 to the Consolidated Financial

Statements, the Company is involved in a number of legal

actions and claims, some of which could potentially result

in material cash payments. Adverse developments in

those actions could materially and adversely affect the

Company’s liquidity. The Company also has certain

income tax-related contingencies as more fully described

below under “Critical Accounting Policies and Estimates”.

Estimates of these contingent liabilities are included in the

Company’s Consolidated Financial Statements. However,

future negative developments could have a material

adverse effect on the Company’s liquidity. See Notes 5

and 8 to the Consolidated Financial Statements.

On November 30, 2004, the Board of Directors autho-

rized the Company to repurchase up to 10 million

shares of its outstanding common stock in the open

market or in privately negotiated transactions from

time to time subject to market conditions. The objective

of the share repurchase program is to enhance share-

holder value by purchasing shares at a price that

produces a return on investment that is greater than

the Company’s cost of capital. Additionally, share

repurchases will be undertaken only if such purchases

result in an accretive impact on the Company’s fully

diluted earnings per share calculation. This authorization

expires November 30, 2005. During 2004, the Company

purchased approximately 0.5 million shares pursuant to

this authorization at a total cost of $10.9 million.

On March 13, 2003, the Board of Directors authorized

the Company to repurchase up to 12 million shares of its

outstanding common stock, with provisions and objec-

tives similar to the November 30, 2004 authorization

discussed above. This authorization expired March 13,

2005. During 2003, the Company purchased approxi-

mately 1.5 million shares at a total cost of $29.7 million.

During 2004, the Company purchased approximately

10.5 million shares at a total cost of $198.4 million.

As of January 28, 2005, approximately 12.0 million

shares had been purchased, substantially completing

this share repurchase authorization. Share repurchases

in 2004 increased diluted earnings per share by

approximately $0.02.

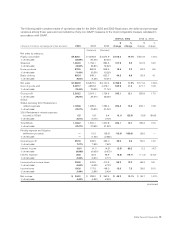

The following table summarizes the Company’s significant contractual obligations as of January 28, 2005 (in thousands):

Payments Due by Period

Contractual obligations Total < 1 yr 1–3 yrs 3–5 yrs > 5 yrs

Long-term debt(a) $ 200,000 $ — $ — $ — $ 200,000

Capital lease obligations 28,178 12,021 9,502 3,188 3,467

Financing obligations 91,555 1,886 4,628 4,943 80,098

Inventory purchase obligations 98,767 98,767 — — —

Interest(b) 193,822 26,592 50,660 48,720 67,850

Operating leases 1,165,045 251,462 369,636 220,869 323,078

Total contractual cash obligations $ 1,777,367 $ 390,728 $ 434,426 $ 277,720 $ 674,493

(a) As discussed below, represents unsecured notes whose holders have a redemption option in 2005, which could result in the accelerated payment

of all or a portion of these obligations.

(b) Represents obligations for interest payments on long-term debt, capital lease and financing obligations.

The Company has a $250 million revolving credit facility (the “Credit Facility”), which expires in June 2009. As of

January 28, 2005, the Company had no outstanding borrowings and $8.7 million of standby letters of credit outstanding

under the Credit Facility. The standby letters of credit reduce the borrowing capacity of the Credit Facility. The Credit

Facility contains certain financial covenants, all of which the Company was in compliance with at January 28, 2005. See

Note 6 to the Consolidated Financial Statements for further discussion of the Credit Facility.