Dollar General 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 1

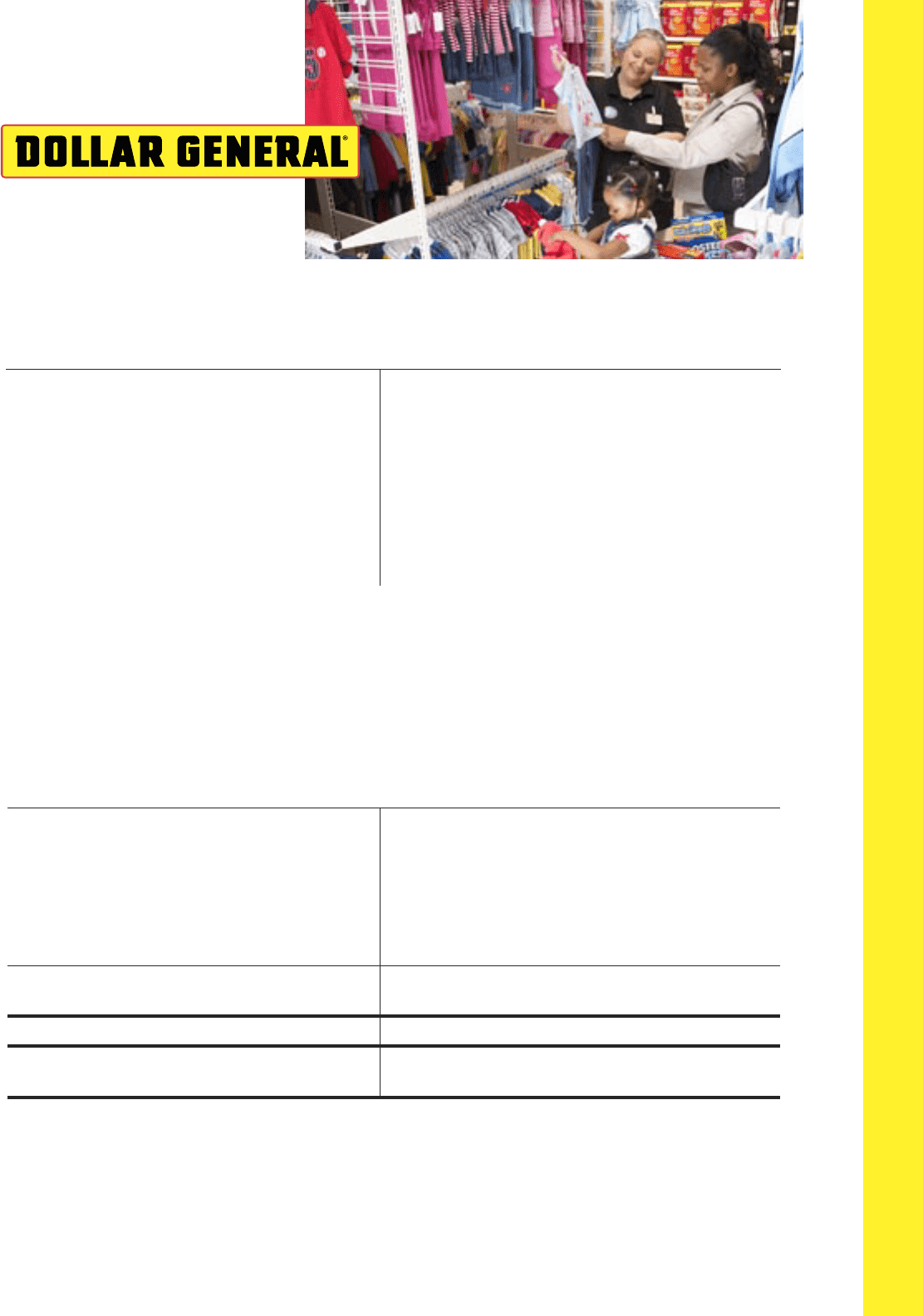

Financial Highlights

January 28, January 30, January 31, February 1, February 2,

(Dollars in thousands except per share data) 2005 2004 (b) 2003 (b) 2002 (b) 2001 (b) (c)

Net sales $ 7,660,927 $ 6,871,992 $ 6,100,404 $ 5,322,895 $ 4,550,571

Net income $ 344,190 $ 299,002 $ 262,351 $ 203,874 $ 66,955

Diluted earnings per share (a) $ 1.04 $ 0.89 $ 0.78 $ 0.61 $ 0.20

Basic earnings per share (a) $ 1.04 $ 0.89 $ 0.79 $ 0.61 $ 0.20

Cash dividends per share of

common stock (a) $ 0.16 $ 0.14 $ 0.13 $ 0.13 $ 0.12

Total assets $ 2,841,004 $ 2,621,117 $ 2,303,619 $ 2,526,481 $ 2,271,217

Long-term obligations $ 258,462 $ 265,337 $ 330,337 $ 339,470 $ 720,764

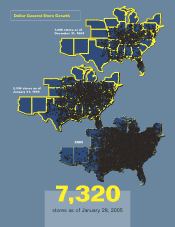

Total number of stores 7,320 6,700 6,113 5,540 5,000

Same-store sales increase 3.2% 4.0% 5.7% 7.3% 0.9%

Non-GAAP Disclosures

The Letter to Shareholders and the graph on page 6 include earnings per share (“EPS”), excluding items relating to the restatement

of the Company’s 1998 through 2000 financial results (the “2001 Restatement”), a measure not derived in accordance with generally

accepted accounting principles (“GAAP”). The table below shows the reconciliation of this measure to EPS computed in accordance

with GAAP. Management believes that this information indicates more clearly the Company’s comparative year-to-year operating

results. This information should not be considered a substitute for EPS derived in accordance with GAAP.

January 28, January 30, January 31, February 1, February 2,

(Dollars in thousands except per share data) 2005 2004 (b) 2003 (b) 2002 (b) 2001 (b) (c)

Net income, in accordance with GAAP $344,190 $299,002 $262,351 $203,874 $ 66,955

2001 Restatement-related items:

Penalty expense and litigation

settlement expense (proceeds) —10,000 (29,541) — 162,000

2001 Restatement-related expenses

included in SG&A 452 591 6,395 28,422 —

Tax effect (177) (232) 9,073 (10,431) (63,000)

Net income, excluding 2001

Restatement-related items $344,465 $309,361 $248,278 $221,865 $165,955

Weighted average diluted shares (a) 332,068 337,636 335,050 335,017 333,858

Diluted earnings per share, excluding

2001 Restatement-related items (a) $ 1.04 $ 0.92 $ 0.74 $ 0.66 $ 0.50

(a) As adjusted to give retroactive effect to all common stock splits.

(b) The Company restated its financial statements for fiscal years 2000 through 2003 as discussed in Note 2 to the Consolidated Financial Statements for

the year ended January 28, 2005, included in this Annual Report. For fiscal years 2001 and 2000, this restatement reduced previously reported net

income by approximately $3.6 million and $3.7 million, respectively, or approximately $.01 per diluted share in each year.

(c) 53-week year.