Dish Network 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

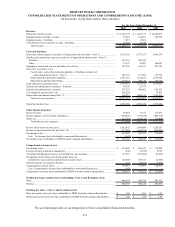

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-9

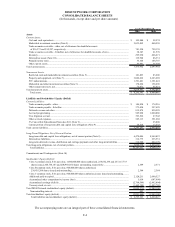

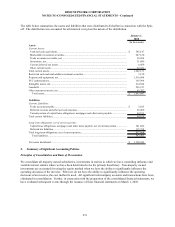

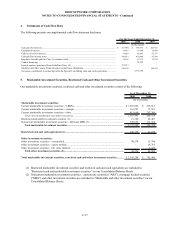

The table below summarizes the assets and liabilities that were distributed to EchoStar in connection with the Spin-

off. The distribution was accounted for at historical cost given the nature of the distribution.

January 1,

2008

(In thousands)

Assets

Current Assets:

Cash and cash equivalents.......................................................................................................... 585,147$

Marketable investment securities............................................................................................... 947,120

Trade accounts receivable, net................................................................................................... 38,054

Inventories, net........................................................................................................................... 31,000

Current deferred tax assets......................................................................................................... 8,459

Other current assets.................................................................................................................... 32,351

Total current assets....................................................................................................................... 1,642,131

Restricted cash and marketable investment securities.................................................................. 3,150

Property and equipment, net......................................................................................................... 1,516,604

FCC authorizations....................................................................................................................... 165,994

Intangible assets, net..................................................................................................................... 214,544

Goodwill....................................................................................................................................... 256,917

Other noncurrent assets, net ........................................................................................................ 93,707

Total assets.............................................................................................................................. 3,893,047$

Liabilities

Current Liabilities:

Trade accounts payable.............................................................................................................. 5,825$

Deferred revenue and other accrued expenses............................................................................ 38,460

Current portion of capital lease obligations, mortgages and other notes payable....................... 40,533

Total current liabilities................................................................................................................. 84,818

Long-term obligations, net of current portion:

Capital lease obligations, mortgages and other notes payable, net of current portion................ 341,886

Deferred tax liabilities................................................................................................................ 115,798

Total long-term obligations, net of current portion...................................................................... 457,684

Total liabilities........................................................................................................................ 542,502

Net assets distributed.................................................................................................................... 3,350,545$

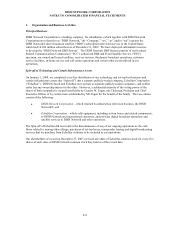

2. Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

We consolidate all majority owned subsidiaries, investments in entities in which we have controlling influence and

variable interest entities where we have been determined to be the primary beneficiary. Non-majority owned

investments are accounted for using the equity method when we have the ability to significantly influence the

operating decisions of the investee. When we do not have the ability to significantly influence the operating

decisions of an investee, the cost method is used. All significant intercompany accounts and transactions have been

eliminated in consolidation. Further, in connection with the preparation of the consolidated financial statements, we

have evaluated subsequent events through the issuance of these financial statements on March 1, 2010.