Dish Network 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-16

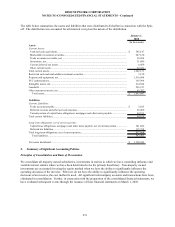

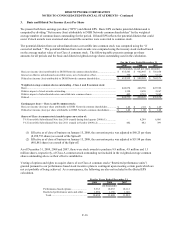

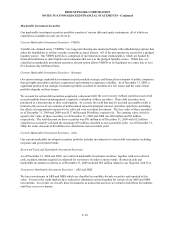

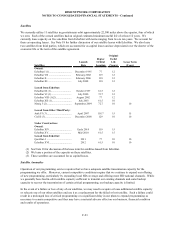

3. Basic and Diluted Net Income (Loss) Per Share

We present both basic earnings per share (“EPS”) and diluted EPS. Basic EPS excludes potential dilution and is

computed by dividing “Net income (loss) attributable to DISH Network common shareholders” by the weighted-

average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution that could

occur if stock awards were exercised and convertible securities were converted to common stock.

The potential dilution from our subordinated notes convertible into common stock was computed using the “if

converted method.” The potential dilution from stock awards was computed using the treasury stock method based

on the average market value of our Class A common stock. The following table presents earnings per share

amounts for all periods and the basic and diluted weighted-average shares outstanding used in the calculation.

2009 2008 2007

Basic net income (loss) attributable to DISH Network common shareholders............................. $ 635,545 $ 902,947 $ 756,054

Interest on dilutive subordinated convertible notes, net of related tax effect................................ 390 6,638 9,517

Diluted net income (loss) attributable to DISH Network common shareholders.......................... $ 635,935 $ 909,585 $ 765,571

Weighted-average common shares outstanding - Class A and B common stock:

Basic............................................................................................................................................. 446,874 448,786 447,302

Dilutive impact of stock awards outstanding................................................................................ 1,320 2,659 2,267

Dilutive impact of subordinated notes convertible into common shares....................................... 402 8,781 7,265

Diluted.......................................................................................................................................... 448,596 460,226 456,834

Earnings per share - Class A and B common stock:

Basic net income (loss) per share attributable to DISH Network common shareholders.............. $ 1.42 $ 2.01 $ 1.69

Diluted net income (loss) per share attributable to DISH Network common shareholders........... $ 1.42 $ 1.98 $ 1.68

Shares of Class A common stock issuable upon conversion of:

3% Convertible Subordinated Note due 2010 (repaid during third quarter 2008) (1)............... - 8,299 6,866

3% Convertible Subordinated Note due 2011 (repaid in October 2009) (2)............................. 482 482 399

For the Years Ended December 31,

(In thousands, except per share amounts)

(1) Effective as of close of business on January 15, 2008, the conversion price was adjusted to $60.25 per share

(8,298,755 shares) as a result of the Spin-off.

(2) Effective as of close of business on January 15, 2008, the conversion price was adjusted to $51.88 per share

(481,881 shares) as a result of the Spin-off.

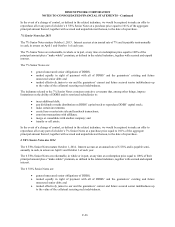

As of December 31, 2009, 2008 and 2007, there were stock awards to purchase 8.9 million, 4.9 million and 1.3

million shares, respectively, of Class A common stock outstanding not included in the weighted-average common

shares outstanding above as their effect is antidilutive.

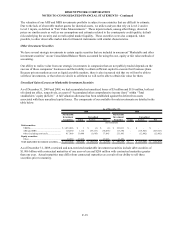

Vesting of options and rights to acquire shares of our Class A common stock (“Restricted performance units”)

granted pursuant to our performance based stock incentive plans is contingent upon meeting certain goals which are

not yet probable of being achieved. As a consequence, the following are also not included in the diluted EPS

calculation.

2009 2008 2007

Performance-based options........................ 9,363 10,253 10,112

Restricted performance units and other...... 1,096 1,156 1,140

Total....................................................... 10,459 11,409 11,252

For the Years Ended December 31,

(In thousands)