Dish Network 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-33

11. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C common stock are equivalent except for voting rights. Holders of Class A and Class

C common stock are entitled to one vote per share and holders of Class B common stock are entitled to 10 votes per

share. Each share of Class B and Class C common stock is convertible, at the option of the holder, into one share of

Class A common stock. Upon a change in control of DISH Network, each holder of outstanding shares of Class C

common stock is entitled to 10 votes for each share of Class C common stock held. Our principal stockholder owns the

majority of all outstanding Class B common stock and, together with all other stockholders, owns outstanding Class A

common stock. There are no shares of Class C common stock outstanding.

Common Stock Repurchase Program

Our Board of Directors previously authorized stock repurchases of up to $1.0 billion of our Class A common stock.

On November 3, 2009, our Board of Directors extended the plan and authorized an increase in the maximum dollar

value of shares that may be repurchased under the plan, such that we are authorized to repurchase up to $1.0 billion

of our outstanding shares through and including December 31, 2010.

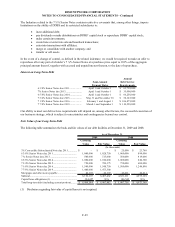

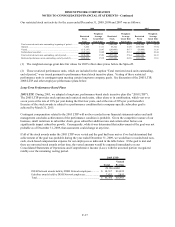

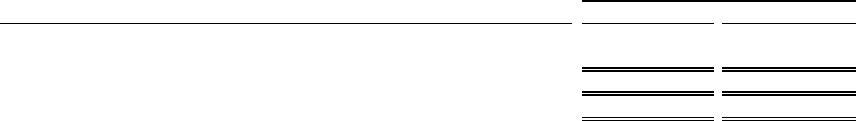

The following table provides information regarding repurchases of our Class A common stock.

Class A Common Stock Re

p

urchases 2009 2008

Total number of shares repurchased.................................................................... 1,948 3,137

Dollar value of shares repurchased...................................................................... $ 18,594 $ 82,733

Remaining dollar value of shares that may be repurchased under the plan.......... $ 1,000,000 $ 999,173

For the Years Ended December 31,

(In thousands)

Cash Dividend

On December 2, 2009, we paid a cash dividend of $2.00 per share, or approximately $894 million, on our outstanding

Class A and Class B common stock to shareholders of record at the close of business on November 20, 2009.

12. Employee Benefit Plans

Employee Stock Purchase Plan

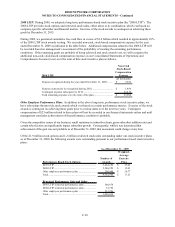

During 1997, the Board of Directors and stockholders approved an employee stock purchase plan (the “ESPP”).

During 2006, this plan was amended for the purpose of registering an additional 1.0 million shares of Class A

common stock, such that we were authorized to issue a total of 1.8 million shares of Class A Common stock. At

December 31, 2009, we had 0.7 million remaining Class A common stock available for issuance under this plan.

Substantially all full-time employees who have been employed by us for at least one calendar quarter are eligible to

participate in the ESPP. Employee stock purchases are made through payroll deductions. Under the terms of the

ESPP, employees may not deduct an amount which would permit such employee to purchase our capital stock under

all of our stock purchase plans at a rate which would exceed $25,000 in fair value of capital stock in any one year.

The purchase price of the stock is 85% of the closing price of the Class A common stock on the last business day of

each calendar quarter in which such shares of Class A common stock are deemed sold to an employee under the

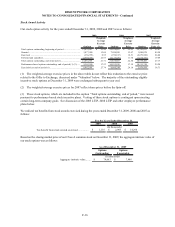

ESPP. During the years ended December 31, 2009, 2008 and 2007, employee purchases of Class A common stock

through the ESPP totaled approximately 0.2 million, 0.1 million and 0.1 million shares, respectively.