Dish Network 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-36

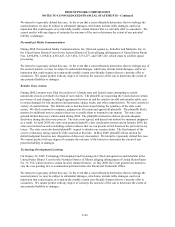

Stock Award Activity

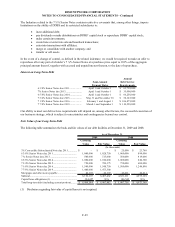

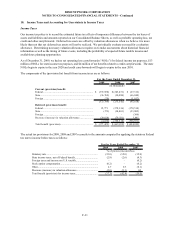

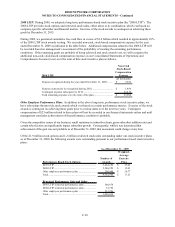

Our stock option activity for the years ended December 31, 2009, 2008 and 2007 was as follows:

Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price (2)

Total options outstanding, beginning of period.............................. 21,835,687 22.50$ 20,938,403 22.61$ 22,741,833 25.67$

Granted .......................................................................................... 3,077,000 15.69 7,998,500 13.67 1,890,870 40.50

Exercised ....................................................................................... (356,793) 8.95 (976,187) 19.51 (2,079,909) 24.88

Forfeited and cancelled.................................................................. (2,694,203) 22.93 (6,125,029) 11.70 (1,614,391) 19.69

Total options outstanding, end of period (1).................................. 21,861,691 21.71 21,835,687 22.50 20,938,403 27.17

Performance based options outstanding, end of period (1) (3)....... 9,362,500 17.23 10,253,250 17.19 10,111,750 20.28

Exercisable at end of period (1)..................................................... 8,062,091 27.74 6,606,244 29.16 5,976,459 34.73

2009 2008 2007

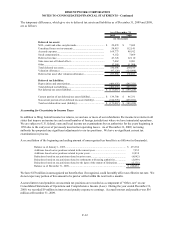

(1) The weighted-average exercise prices in the above table do not reflect this reduction to the exercise price

related to the Offer to Exchange, discussed under “Valuation” below. The majority of the outstanding eligible

incentive stock options at December 31, 2009 were exchanged subsequent to year end.

(2) The weighted-average exercise prices for 2007 reflect share prices before the Spin-off.

(3) These stock options, which are included in the caption “Total options outstanding, end of period,” were issued

pursuant to performance-based stock incentive plans. Vesting of these stock options is contingent upon meeting

certain long-term company goals. See discussion of the 2005 LTIP, 2008 LTIP and other employee performance

plans below.

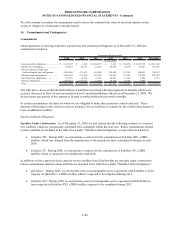

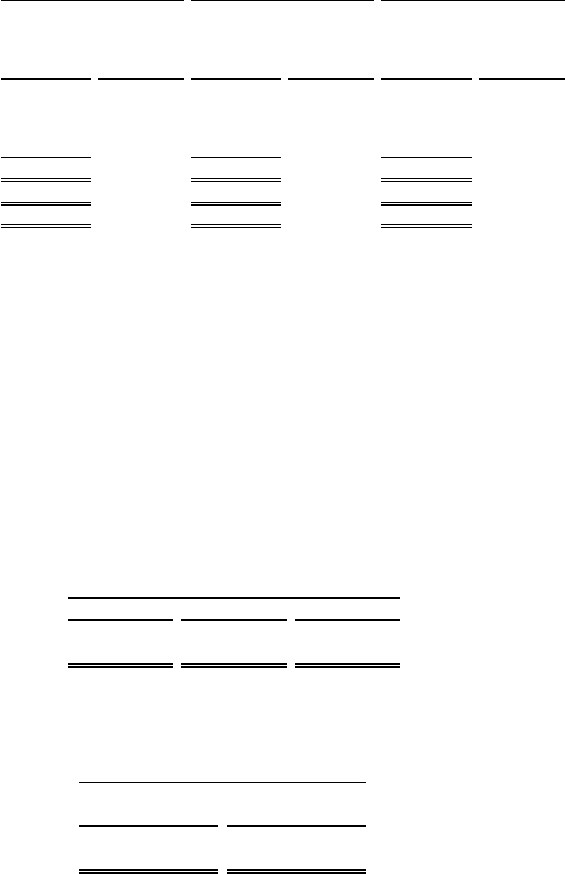

We realized tax benefits from stock awards exercised during the years ended December 31, 2009, 2008 and 2007 as

follows:

2009 2008 2007

Tax benefit from s tock awards exercised................. $ 1,116 $ 2,905 $ 14,294

(In thousands)

For the Years Ended December 31,

Based on the closing market price of our Class A common stock on December 31, 2009, the aggregate intrinsic value of

our stock options was as follows:

Options

Outstanding

Options

Exercisable

Aggregate intrinsic value........ 74,663$ 7,486$

As of December 31, 2009

(In thousands)