Dish Network 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

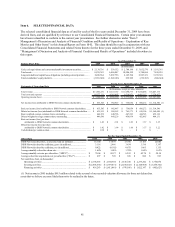

Item 6. SELECTED FINANCIAL DATA

The selected consolidated financial data as of and for each of the five years ended December 31, 2009 have been

derived from, and are qualified by reference to our Consolidated Financial Statements. Certain prior year amounts

have been reclassified to conform to the current year presentation. See further discussion under “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations – Explanation of Key

Metrics and Other Items” in this Annual Report on Form 10-K. This data should be read in conjunction with our

Consolidated Financial Statements and related Notes thereto for the three years ended December 31, 2009, and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in

this report.

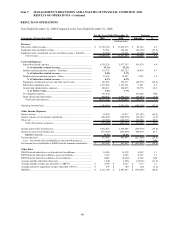

Balance Sheet Data 2009 2008 2007 2006 2005

Cash, cash equivalents and current marketable investment securities................ 2,139,336$ 559,132$ 2,788,196$ 3,032,570$ 1,181,361$

Total assets........................................................................................................ 8,295,343 6,460,047 10,086,529 9,768,696 7,410,210

Long-term debt and capital lease obligations (including current portion)......... 6,496,564 5,007,756 6,125,704 6,967,321 5,935,301

Total stockholders' equity (deficit).................................................................... (2,091,688) (1,949,106) 639,989 (219,383) (866,624)

As of December 31,

(In thousands)

Statements of O

p

erations Data 2009 2008 2007 2006 2005

Total revenue ........................................................................................................... 11,664,151$ 11,617,187$ 11,090,375$ 9,818,486$ 8,447,175$

Total costs and expenses ......................................................................................... 10,277,221 9,561,007 9,516,971 8,601,115 7,279,927

Operating income (loss) ........................................................................................... 1,386,930$ 2,056,180$ 1,573,404$ 1,217,371$ 1,167,248$

Net income (loss) attributable to DISH Network common shareholders.................. 635,545$ 902,947$ 756,054$ 608,272$ 1,514,540$ (1)

Basic net income (loss) attributable to DISH Network common shareholders......... 635,545$ 902,947$ 756,054$ 608,272$ 1,514,540$

Diluted net income (loss) attributable to DISH Network common shareholders...... 635,935$ 909,585$ 765,571$ 618,106$ 1,560,688$ (1)

Basic weighted-average common shares outstanding............................................... 446,874 448,786 447,302 444,743 452,118

Diluted weighted-average common shares outstanding............................................ 448,596 460,226 456,834 452,685 484,131

Basic net income (loss) per share

attributable to DISH Network common shareholders........................................ 1.42$ 2.01$ 1.69$ 1.37$ 3.35$

Diluted net income (loss) per share

attributable to DISH Network common shareholders........................................ 1.42$ 1.98$ 1.68$ 1.37$ 3.22$

Cash dividend per common share............................................................................. 2.00$ -$ -$ -$ -$

For the Years Ended December 31,

(In thousands, except per share amounts)

Other Data 2009 2008 2007 2006 2005

DISH Network subscribers, as of period end (in millions)....................... 14.100 13.678 13.780 13.105 12.040

DISH Network subscriber additions, gross (in millions).......................... 3.118 2.966 3.434 3.516 3.397

DISH Network subscriber additions, net (in millions).............................. 0.422 (0.102) 0.675 1.065 1.135

Average monthly subscriber churn rate.................................................... 1.64% 1.86% 1.70% 1.64% 1.65%

Average monthly revenue per subscriber ("ARPU")............................... 70.04$ 69.27$ 65.83$ 62.78$ 58.34$

Average subscriber acquisition cost per subscriber ("SAC").................... 697$ 720$ 656$ 686$ 693$

Net cash flows from (in thousands):

Operating activities ............................................................................. 2,194,543$ 2,188,344$ 2,616,720$ 2,279,242$ 1,774,074$

Investing activities .............................................................................. (2,605,556)$ (1,597,471)$ (2,470,832)$ (2,148,968)$ (1,478,762)$

Financing activities ............................................................................. 418,283$ (1,411,841)$ (976,016)$ 1,022,147$ (402,623)$

For the Years Ended December 31,

(1) Net income in 2005 includes $915 million related to the reversal of our recorded valuation allowance for those net deferred tax

assets that we believe are more likely than not to be realized in the future.