Dish Network 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

61

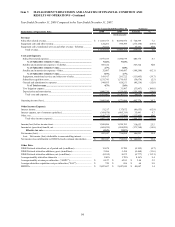

The decrease in net cash outflows from investing activities from 2007 to 2008 of $873 million primarily resulted from a

net decrease in purchases of marketable investment securities, a decrease in cash used for purchases of property and

equipment, a decrease in cash used for the purchases of strategic investments, including Sling Media, and an increase in

proceeds from the sale of investments. The overall net decreases were partially offset by an increase in cash used for

purchases of FCC licenses during 2008 compared to 2007.

Cash flows from financing activities. Our financing activities generally include net proceeds related to the issuance of

long-term debt, cash used for the repurchase, redemption or payment of long-term-debt and capital lease obligations,

dividends paid on our Class A and Class B common stock and repurchases of our Class A common stock. For the year

ended December 31, 2009, we reported net cash inflows from financing activities of $418 million. For the years ended

December 31, 2008 and 2007, we reported net cash outflows from financing activities of $1.412 billion and $976

million, respectively.

The increase in net cash inflows from 2008 to 2009 primarily resulted from a decrease in the repayment of long-term

debt and capital lease obligations, an increase in the net proceeds related to the issuance of long-term debt and a decline

in stock repurchases. This increase in net cash inflows was partially offset by the dividend payment of $894 million

during 2009. In addition, the 2008 cash outflows were negatively impacted by the distribution to EchoStar related to

the Spin-off.

The increase in net cash outflows from 2007 to 2008 includes an increase in cash outflows for debt redemptions,

distributions related to the Spin-off and stock repurchases. This increase in net cash outflows was partially offset by an

increase in cash inflows related to issuance of new debt during 2008.

Other Liquidity Items

700 MHz Spectrum

In 2008, we paid $712 million to acquire certain 700 MHz wireless licenses, which were granted to us by the FCC in

February 2009. To commercialize these licenses and satisfy FCC build-out requirements, we will be required to

make significant additional investments or partner with others. Depending on the nature and scope of such

commercialization and build-out, any such investment or partnership could vary significantly. Part or all of our

licenses may be terminated for failure to satisfy FCC build-out requirements. We are currently performing a market

test to evaluate different technologies and consumer acceptance.

Subscriber Churn

DISH Network added approximately 422,000 net new subscribers for the year ended December 31, 2009, compared

to losing approximately 102,000 net subscribers during the same period in 2008. This increase primarily resulted

from an increase in gross new subscribers and a decrease in our subscriber churn rate to 1.64% compared to 1.86%

for the same period in 2008. See “Results of Operations” above for further discussion.

Our distribution relationship with AT&T was a substantial contributor to our gross and net subscriber additions in

prior years, accounting for approximately 17% of our gross subscriber additions for the year ended December 31,

2008. This distribution relationship ended January 31, 2009. Consequently, beginning with the second quarter

2009, AT&T no longer contributed to our gross subscriber additions. In addition, nearly one million of our current

subscribers were acquired through our distribution relationship with AT&T and subscribers acquired through this

channel have historically churned at a higher rate than our overall subscriber base. Although AT&T is not permitted

to target these subscribers for transition to another pay-TV service and we and AT&T are required to maintain

bundled billing and cooperative customer service for these subscribers, these subscribers may continue to churn at

higher than historical rates following termination of the AT&T distribution relationship.