Dish Network 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-37

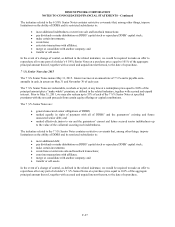

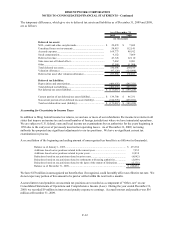

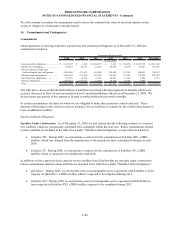

Our restricted stock unit activity for the years ended December 31, 2009, 2008 and 2007 was as follows:

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value (1)

Total restricted stock units outstanding, beginning of period............. 1,975,940 27.44$ 2,240,284 28.53$ 1,378,504 31.12$

Granted .............................................................................................. 6,666 11.11 88,322 11.09 1,039,580 37.94

Vested................................................................................................. (113,197) 28.47 (280,000) 30.77 (30,000) 31.16

Forfeited and cancelled...................................................................... (623,125) 30.09 (72,666) 29.33 (147,800) 30.44

Total restricted stock units outstanding, end of period....................... 1,246,284 25.93 1,975,940 27.44 2,240,284 34.33

Restricted performance units outstanding, end of period (2).............. 1,096,034 25.18 1,155,940 24.96 1,140,284 31.61

20082009 2007

(1) The weighted-average grant date fair values for 2007 reflect share prices before the Spin-off.

(2) These restricted performance units, which are included in the caption “Total restricted stock units outstanding,

end of period,” were issued pursuant to performance-based stock incentive plans. Vesting of these restricted

performance units is contingent upon meeting certain long-term company goals. See discussion of the 2005 LTIP,

2008 LTIP and other employee performance plans below.

Long-Term Performance-Based Plans

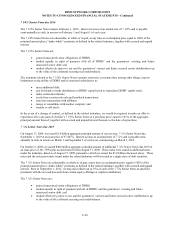

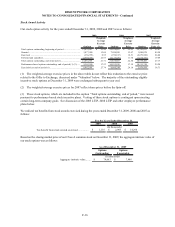

2005 LTIP. During 2005, we adopted a long-term, performance-based stock incentive plan (the “2005 LTIP”).

The 2005 LTIP provides stock options and restricted stock units, either alone or in combination, which vest over

seven years at the rate of 10% per year during the first four years, and at the rate of 20% per year thereafter.

Exercise of the stock awards is subject to a performance condition that a company-specific subscriber goal is

achieved by March 31, 2015.

Contingent compensation related to the 2005 LTIP will not be recorded in our financial statements unless and until

management concludes achievement of the performance condition is probable. Given the competitive nature of our

business, small variations in subscriber churn, gross subscriber addition rates and certain other factors can

significantly impact subscriber growth. Consequently, while it was determined that achievement of the goal was not

probable as of December 31, 2009, that assessment could change at any time.

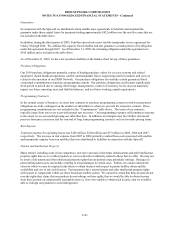

If all of the stock awards under the 2005 LTIP were vested and the goal had been met or if we had determined that

achievement of the goal was probable during the year ended December 31, 2009, we would have recorded total non-

cash, stock-based compensation expense for our employees as indicated in the table below. If the goal is met and

there are unvested stock awards at that time, the vested amounts would be expensed immediately on our

Consolidated Statements of Operations and Comprehensive Income (Loss), with the unvested portion recognized

ratably over the remaining vesting period.

Total

Vested

Portion

DISH Network awards held by DISH Network employees............ 38,537$ 14,052$

EchoStar awards held by DISH Network employees...................... 7,823 2,853

Total............................................................................................... 46,360$ 16,905$

2005 LTIP

(In thousands)