Dish Network 2009 Annual Report Download - page 65

Download and view the complete annual report

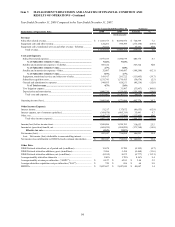

Please find page 65 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

55

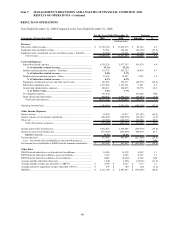

DISH Network subscribers. As of December 31, 2008, we had approximately 13.678 million DISH Network

subscribers compared to approximately 13.780 million subscribers at December 31, 2007, a decrease of 102,000 or

0.7%. DISH Network added approximately 2.966 million gross new subscribers for the year ended December 31,

2008, compared to approximately 3.434 million gross new subscribers during 2007, a decrease of approximately

468,000 gross new subscribers.

DISH Network lost approximately 102,000 net subscribers for the year ended December 31, 2008, compared to

adding approximately 675,000 net new subscribers during the same period in 2007. This decrease primarily resulted

from lower gross new subscribers discussed above, an increase in our subscriber churn rate, and churn on a larger

average subscriber base for the year. Our average monthly subscriber churn for the year ended December 31, 2008

was 1.86%, compared to 1.70% for the same period in 2007.

We believe our gross and net subscriber additions as well as our subscriber churn were negatively impacted by weak

economic conditions, aggressive promotional and retention offerings by our competition, our relative discipline in

our own promotional and retention activities including the amount of discounted programming or equipment we

have offered, the heavy marketing of HD service by our competition, the growth of fiber-based and Internet-based

pay TV providers, signal theft and other forms of fraud, and operational inefficiencies at DISH Network. Most of

these factors have affected both gross new subscriber additions as well as existing subscriber churn.

Subscriber-related revenue. DISH Network “Subscriber-related revenue” totaled $11.456 billion for the year ended

December 31, 2008, an increase of $765 million or 7.2% compared to 2007. This increase was primarily related to

the increase in “ARPU” discussed below and a higher average subscriber base in 2008 compared to 2007.

ARPU. Average monthly revenue per subscriber was $69.27 during the year ended December 31, 2008 versus $65.83

during the same period in 2007. The $3.44 or 5.2% increase in ARPU was primarily attributable to (i) price increases

in February 2008 and 2007 on some of our most popular programming packages, (ii) an increase in hardware related

fees, including rental fees and fees for DVRs, (iii) increased penetration of HD programming driven in part by the

availability of HD local channels, (iv) an increase in fees earned from our in-home service operations, and (v)

increased advertising revenue. This increase was partially offset by a decrease in revenue from our original

agreement with AT&T.

Equipment sales and other revenue. “Equipment sales and other revenue” totaled $124 million during the year ended

December 31, 2008, a decrease of $275 million or 68.9% compared to the same period during 2007. The decrease in

“Equipment sales and other revenue” primarily resulted from the distribution of our set-top box business and certain

other revenue-generating assets to EchoStar in connection with the Spin-off, partially offset by increases in other

revenue. During the year ended December 31, 2007, our set-top box business that was distributed to EchoStar

accounted for $282 million of our “Equipment sales and other revenue.”

Equipment sales, transitional services and other revenue – EchoStar. “Equipment sales, transitional services and

other revenue – EchoStar” totaled $37 million during the year ended December 31, 2008 as a result of the Spin-off.

Subscriber-related expenses. “Subscriber-related expenses” totaled $5.977 billion during the year ended December

31, 2008, an increase of $481 million or 8.7% compared to the same period in 2007. The increase in “Subscriber-

related expenses” was primarily attributable to higher costs for: (i) programming content, (ii) customer retention, (iii)

call center operations, (iv) in-home service operations, (v) the refurbishment and repair of receiver systems used in

our equipment lease programs, partially offset by a decrease in costs associated with our original agreement with

AT&T. The increase in customer retention expense was primarily driven by more upgrading of existing customers

to HD and DVR receivers and the changing of equipment for certain subscribers to make more efficient use of

satellite bandwidth in support of HD and other initiatives. We believe that the benefit from the increase in available

satellite bandwidth outweighs the short-term cost of these equipment changes. The increases related to call center

and in-home service operations were driven in part by our investments in staffing, training, information systems, and

other initiatives. These investments are intended to help combat inefficiencies introduced by the increasing

complexity of our business and technology, improve customer satisfaction, reduce churn, increase productivity, and

allow us to better scale our business over the long run. We cannot, however, be certain that our increased spending

will ultimately yield these benefits. In the meantime, we may continue to incur higher costs as a result of both our

operational inefficiencies and increased spending. “Subscriber-related expenses” represented 52.2% and 51.4% of